The conclusion of the recent Annual Election Period (AEP) has prompted health plans to begin evaluating the effectiveness of their product, sales and marketing strategies in an increasingly competitive Medicare Advantage (MA) market. The release of enrollment files that reflect plan performance during this period highlights the criticality of benefit design (among other factors) on plan success.

Studies have previously suggested that MA members are “sticky” and rarely change coverage; however, this behavior may be changing given the proliferation of product options and availability of rich benefits. For example, at the recent JP Morgan Healthcare Conference, Humana reported that 50% of its membership growth during AEP came from competitors compared to 30% in 2022. A major driver of its growth is a byproduct of the $1B of cost savings from 2022 that were reinvested in benefits. And more broadly, the Deft Executive Research Brief on the 2023 Medicare Shopping and Switching Study reported that percentage of seniors switching MA plans was up to 15% this AEP, which is the highest switch rate seen in the past seven years.

In our 2022 Executive Brief, we discussed the proliferation of “table stakes” benefit offerings and opportunities for plans to differentiate via the next frontier of supplemental benefits focusing on Social Determinants of Health (SDoH). Building off of those learnings, this paper examines the trends in supplemental benefit offerings by health plan over time, highlighting themes across types of supplemental benefits, plan type (e.g., Nationals vs. Blues vs. Provider Sponsored Plans vs. Start-Ups)1, and Special Needs Plan (SNP) category. We will close with our perspective outlining key actions and strategic priorities for plans to respond to this ever-evolving supplemental benefit landscape, particularly in light of upcoming product development and bid planning efforts for 2024.

Prevalence and Trends in Supplemental Benefits

In Figure 1, we compare the level of adoption of various supplemental benefits on the y axis (“2023 Benefit Prevalence”) to the growth in adoption of these benefits over the past three years (“3-Year Percent Change in Prevalence”).

Figure 1: 2023 Prevalence and 3-Year Percent Change in Prevalence

Certain supplemental benefits such as dental, vision and hearing coverage have achieved “table stakes” status as defined by over 90% of plans offering some level of coverage for these benefits in 2023. Given their high prevalence and maturity in market, it is not unexpected that the growth rate for each of these benefits has slowed between 2020 and 2023.

A few benefits, notably fitness, over-the-counter services (OTC), and home health, could be considered “Emerging Table Stakes” as they are rapidly approaching the 90% threshold for table stakes prominence. In 2023, fitness, OTC, and home health, were offered by 89%, 82%, and 81% of plans, respectively. Aligned to the experience of the traditional “table stakes” benefits, we expect the overall prevalence of these benefits to plateau in the coming years.

Compared to other supplemental benefits, the prevalence of meal benefits has grown rapidly between 2020 and 2023 from 46% to 67%, perhaps driven by emerging preferences following the COVID-19 pandemic and the increasing body of research that quantifies the value of meal benefits in reducing adverse health events. Given this rapid adoption, it will be an important benefit for plans to monitor to determine alignment with the product portfolio and value (see Implications for Health Plans).

The percentage of plans offering “Enhanced Preventive”2 benefits increased from 45% to 55% between 2020 and 2023 though these benefits are not as prevalent in the market as Meals. Services under this benefit are correlated with trends towards “aging in place” to meet seniors’ preferences and manage medical cost. As these are newer benefit offerings, their future trajectory will depend on plans’ strategy and how effective these benefits are in delivering on this stated value proposition.

The prevalence of transportation benefits grew from 42% to 50% between 2020 and 2023. The saturation point of the transportation benefit may be lower than that of other supplemental benefits given that the need for a transportation benefit may be dependent on the demographics of plan beneficiaries (See Supplemental Benefit Trends in Special Needs Plans). Additionally, risk-bearing provider groups may offer a transportation service for their aligned members / patients which negates the need for the plan to offer this service.

Finally, while not pictured in the chart, we believe it is possible that the CMS PBP data may understate the prevalence of flex card benefits given the current benefit filing structure and process. That said, flex cards should not be overlooked as progressive plans use flex cards as an innovation play, particularly related to the table stakes benefits. Many Nationals touted flexible card options this past AEP. One notable example is UnitedHealthcare’s UCard, which functions as a plan ID card; provides access to food, OTC, and utility bill credit; and redeems plan rewards and incentives.

Trends in Supplemental Benefit Offerings by Plan Type

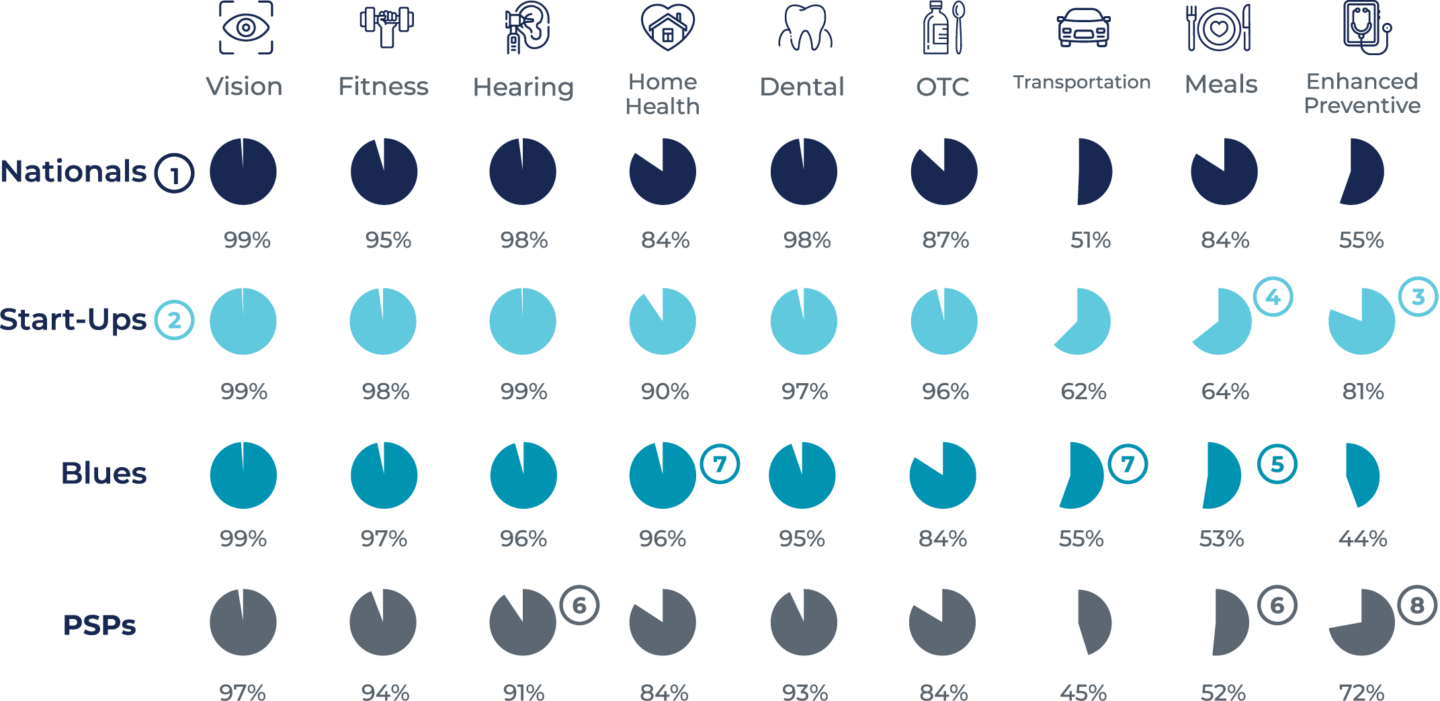

In Figure 2, we compare differences in supplemental benefit prevalence rates by the type of organization, including Nationals, newer entrants to the MA market (Start-Ups), Blue Cross Blue Shield Plans (Blues) and Provider Sponsored Plans (PSPs).

Figure 2: 2023 Benefit Prevalence by Plan Type

- Nationals consistently have a high prevalence of supplemental benefits, likely driven by the substantial reinvestments in benefits made by these types of organizations. In 2023, Nationals offered the “table stakes” dental, vision and hearing benefits, in addition to fitness benefits in at least 95% of their plans. Home health, meals and OTC benefits were also commonly offered, with prevalence rates of 84%, 84%, and 87% respectively.

- Historically, Start-Ups have invested heavily in supplemental benefits as a strategy to drive rapid membership growth in new markets. As a result, Start-Ups typically have supplemental benefit prevalence rates at parity with or higher than the Nationals. In fact, based on most recent data, Start-Ups have the highest prevalence rate in six of the ten supplemental benefits highlighted in this report.

- One of these benefit categories, enhanced preventive benefits, may be an area where Start-Ups are positioning themselves in the market as differentiated; the prevalence rates of Enhanced Preventive benefits for Start-Ups is 25 percentage points higher than the Nationals.

- One notable exception is Meals, where the Start-Up prevalence rate is only 64%, nearly 20 percentage points lower than the Nationals. With few exceptions, the prevalence rate of supplemental benefits offered by both Blues plans and PSPs lagged the Nationals.

- Most notably, Blues plans lagged the Nationals in meals and enhanced preventive services, with prevalence rates more than 30 percentage points and nearly 11 percentage points below the Nationals, respectively.

- Similarly, PSPs markedly fell behind the Nationals in prevalence rate of meals and hearing benefits.

- Blues plans were more likely than the Nationals to offer home health and transportation services.

- PSPs were more likely than the Nationals to offer enhanced preventive services.

Supplemental Benefit Trends in Special Needs Plans (SNPs)

Figure 3: SNP Plan Prevalence Growth Rate

Figure 3 compares the growth of different segments of the SNP market to the non-SNP Individual market. Chronic Special Needs Plans (C-SNPs) experienced the most rapid market growth between 2020 and 2023, with a 23% annual growth rate followed closely by Dual Special Needs Plans (D-SNPs) at 13.5%, although D-SNP plans remain the most prevalent in the market. Institutional Special Needs Plans (I-SNPs) are the smallest SNP segment and grew the most slowly, though at rate comparable to the Individual nonSNP market.

2023 Select Supplemental Benefit Prevalence by SNP Type

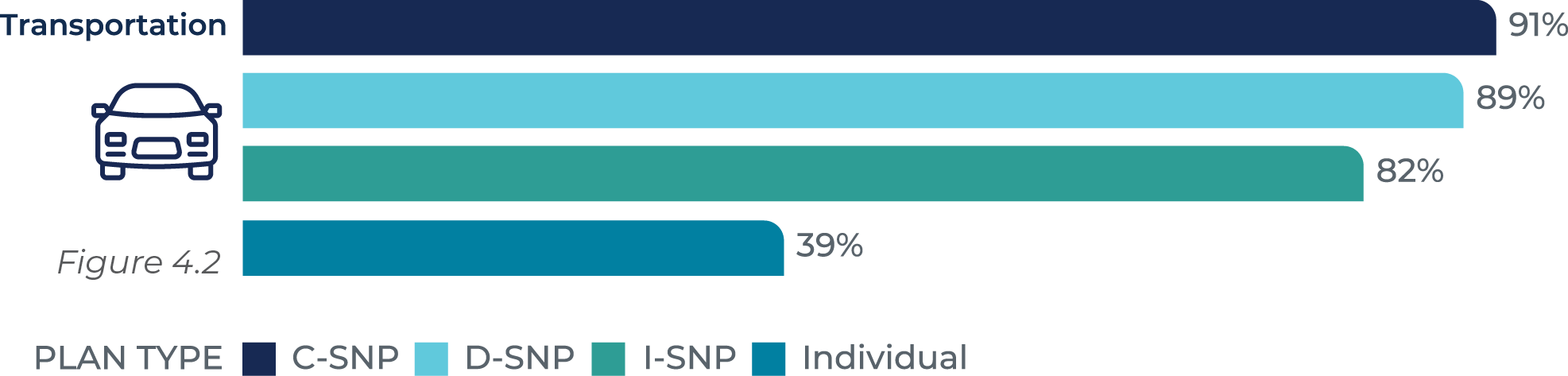

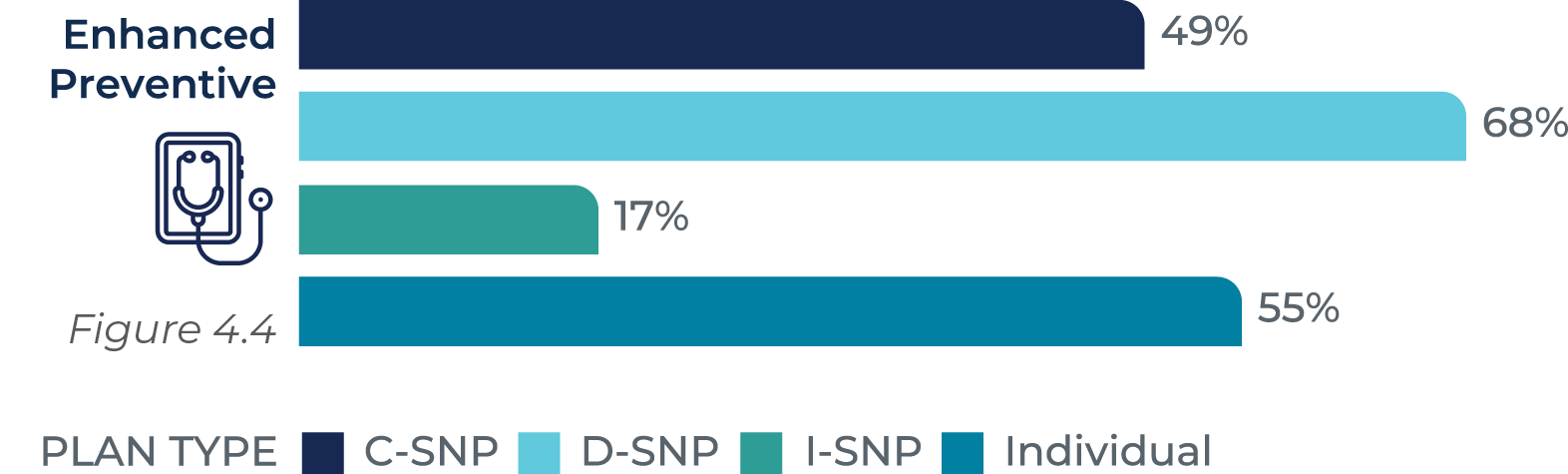

Figures 4.1-4.4 compares the prevalence of select supplemental benefits across different SNP segments and compared to Individual non-SNP. For example, the prevalence of table stakes benefits, such as vision benefits is high for both Individual and SNP plans of all types (Figure 4.1).

However, the prevalence of benefits to address the needs of higher risk populations is higher for SNP plans; for example, transportation benefits (Figure 4.2) are offered by 81-91% of SNP plans versus 39% of Individual non-SNP plans.

Examining benefit prevalence within the different SNP categories shows several differences, some easily explainable and others less so. For example, the prevalence of meal and fitness benefits (Figure 4.3) is lower for I-SNPs vs. C-SNP and D-SNP offerings, partly attributed to the residential component of the I-SNP population.

However, interestingly, D-SNP plans offer enhanced preventive benefits (Figure 4.4) at a higher rate than C-SNP plans, despite both plans treating populations that have chronic conditions and increased risk factors. This difference may be attributable to the relative immaturity of the C-SNP market and we may expect their prevalence to become more common in C-SNPs over time.

While not pictured in the chart above, we also noted that 19% of C-SNP plans filed a flex card benefit offering versus only 9% of D-SNP. While acknowledging that there may be some irregularities in the filing of this flex card benefit type, the higher prevalence in C-SNP plans could be attributed explained by the flexibility offered to leverage the flex cards for multiple benefits to meet the special needs of their members.

Implications for Health Plans

One of the counter-arguments to recent criticism on MA growth and the impact on federal expenditures (especially in defense of risk adjustment) has been that plans re-invest the additional dollars received from the government into benefits for their members. However, it appears that CMS may no longer take that argument at face value and has signaled that it will require a more nuanced understanding of the provision of supplemental benefits to members and their intrinsic value. CMS Administrator Chiquita Brooks-LaSure has stated that determining how supplemental benefits are being used is a top priority for CMS:

“We know when we get Medicare Advantage bids, what people are saying they’re going to spend their dollars on,” she said. “What we want to see more of is, are Medicare beneficiaries using those benefits? What are they using? How are those dollars being spent?” Chiquita Brooks-LaSure, CMS Administrator

The Government Accountability Office (GAO) recently released a report analyzing supplemental benefit prevalence and interviewed CMS and health plan stakeholders related to their understanding of reporting requirements for supplemental benefits, noting that there was confusion from the industry on this point. From this study, the GAO made two recommendations related to clarifying guidance to the extent that encounter data submissions must include data on supplemental benefit utilization and providing further guidance on how to address issues that could impact the submission of this data (e.g., lack of a procedure code for a given benefit). CMS concurred with both recommendations and indicated that it plans to release further guidance that will likely include feedback from the recent Request for Information.

Given this pending scrutiny, combined with the financial stakes given the cost of these benefits and the increasing impact that benefits have on member growth and retention, health plans should consider the following actions:

- Move Beyond “Keeping Up With the Joneses”: While a spreadsheet-based approach to compare plan benefits with those offered in the market is important to gauge benefit level competitiveness, relying solely on this approach places plans in a reactive mode. Our analysis found that there is a great deal of experimentation of different benefit types; thus, offering a benefit solely because it was in a competitor’s plan design does not indicate that the benefit will have broad adoption and be meaningful to drive growth.

- Create Organizational Alignment to Strategy and Product: To shift from this reactive approach to a more proactive one, it is important to create dedicated time and a forum (separate from the bid development process – often preceding it), to take a strategic view to link product with strategy and operations to enhance plan performance. This process will elicit important strategic and operational planning considerations (e.g., network strategies, member experience / attraction / retention, clinical programs, other vended solutions) that must align with MA products and supplemental benefit selection.

- Define the Product Shelf: Plans should ensure that there is a common understanding of the holistic view of all the plan’s products to ensure that each product has a defined space on the “shelf” in that the product appeals to certain targeted consumers / demographics to avoid market confusion. A clear understanding of each product’s target demographics helps to inform which benefits are more valuable for a given member cohort. For example, products that appeal to members with poor health status should have a different supplemental benefit profile than those that may attract younger, healthier members.

- Understand Benefit Uptake and Consumer Perception: To inform the product shelf, plans should understand the utilization of their current supplemental benefits by certain member characteristics and comparisons within the product portfolio and to industry averages / benchmarks. This analysis can be supplemented with external market research to understand consumer preferences. For example, would consumers prefer to offset their Part B premium via a “Give Back” or would they prefer allowances for different benefits? Would consumers prefer to have a large allocation for certain benefits or flexibility to spend dollars across several benefits (e.g., flex card approach)?

- More Than Marketing – What is the ROI: Given the level of competition, limited dollars available to fund benefits in the bid, and the administrative complexity to administer and coordinate with multiple vendors, it is critical to understand the value that supplemental benefits provide outside of benefit attractiveness. For example, benefits related to companion services to address loneliness or meals should have an impact on cost of care or member experience / satisfaction. It is important to have an analytic framework and approach to measure the value of these benefits that normalizes for other impacts to gain a true understanding of the Return on Investment for each benefit. This knowledge will help inform bid development and ensure optimal allocation of previous bid funding.

- Administrative Complexity: As plans offer a greater offering of supplemental benefits, it creates administrative complexity to manage and coordinate an ever-growing portfolio of vendor partnerships. This operational burden should also be accounted for in the strategic decisions mentioned above in terms of which benefits to offer and the mechanism to offer them (e.g., flex card vs. specific benefits).

- Plan for Reporting Requirements: Given CMS’ concurrence with the GAO report, plans should prepare for more specific reporting requirements for supplemental benefit utilization, which could differ from current plan practices. Plans should understand the level of information obtained from vendors’ today on utilization and begin planning for the level of effort that it could take to incorporate utilization of these benefits into its general encounter submission process.

——————————————————————————————————————————————

METHODOLOGY

To conduct our analysis, we reviewed various publicly available sources of information from CMS’ MA/Part D Contract and Enrollment Data. Our analysis focused on MA SNP and Individual MA and MA-PD plans and excluded Employer Group Waiver Plans (EGWP) and Prescription Drug Plans (PDP) We analyzed Plan Benefit Package (PBP) and Contract Summary Files from Q4 2020 through Q1 2023. The analysis and tables primarily show the prevalence of plans offering at least one benefit within a particular benefit category. Benefit categories were based on the PBP files from which they were sourced, except for the “Enhanced Preventive” benefit category.

Note: Q1 2023 PBP files were released in Q4 2022. Specifically, we reviewed the following files to conduct our analysis: CPSC_Contract_Info, pbp_b6_home_health, pbp_b10_amb_ trans, Pbp_b13_other_services, pbp_b14_preventitive, pbp_b16_dental, pbp_b16_eye_ exams_wear, and pbp_b18_hearing_exams.

——————————————————————————————————————————————

HealthScape Can Help

The proliferation and evolution of supplemental benefit offerings present an opportunity for health plans to drive membership and optimize performance of their products. We have supported health plans to evaluate, design and execute competitive strategies for market success.