In the past few years, the COVID-19 pandemic has dominated our attention, disrupting traditional healthcare delivery and access. During this time, member access to care was largely focused on adapting and responding to the pandemic. Now that the industry has largely reached stabilization and is returning to pre-pandemic norms, we see previous emerging trends entrenched as mainstream themes in the healthcare market.

As we continue through 2023, we outline five trends that are impacting the healthcare system more than ever before:

-

Non-traditional players deploy a “Stop at Nothing” approach to disruption

-

Expansive adoption of digital health technology and therapeutics drive changes in care delivery and consumer experience

-

Meaningful progress in the operationalization and realization of health equity

-

Greater push to bring care closer to the home

-

Uptick in personalized medicine

Trend 1: Non-Traditional Players Deploy “Stop at Nothing” Approach to Disruption

The entrance of non-traditional players in healthcare has evolved from a distant, emerging threat to a competitive force that is here to stay and now poised to cause significant disruption. While their foray into healthcare began with incremental (and largely disorganized) tactics, these same retailers and other entities are now aggressively pursuing a “stop at nothing” approach to diversify and disrupt the healthcare value chain. Foundational to their strategy is to meet consumers where they are and prioritize convenience.

Despite their varying levels of engagement across the value chain, we believe all of these entities will prioritize five outcomes given large scale investments in support of these goals:

- Creating a one-stop shop approach to healthcare in familiar, trusted locations:

Walmart Health’s strategy prioritizes the consumer experience congruent with its “Everyday Low Prices” philosophy. It has rapidly expanded its brick and mortar locations that offer end-to-end care and has 16 new clinics targeted for launch in 2023. Combining its retail and healthcare footprint, Walmart has created a “one-stop shop” in locations that are familiar and trusted by consumers and can offer medical, behavioral health, dental, vision, pharmacy and over-the-counter healthcare items in a single, convenient location. - Addressing whole person care from wellness through acute/chronic disease management:

CVS recently acquired home health company, Signify Health to reinforce its commitment to whole person health through an integrated care delivery model. Recent expansion of offerings include services to address mental health, social determinants of health (SDOH) barriers and chronic conditions. These offerings expand CVS’ reach across the care continuum with continued disruption on the horizon. - Leveraging retail scale and reach to become a fully integrated healthcare provider:

Primary and urgent care are at the core of CVS’ retail health strategy, as reinforced by its recent acquisition of Carbon Health. This acquisition expands CVS’ footprint into new markets and accelerates adoption of value-based care arrangements. - Creating omnichannel access to care:

Amazon is largely focused on expanding its healthcare offerings through an omnichannel care delivery approach, as evidenced by its acquisition of One Medical, a telehealth and primary care solution that deploys a consumer centric virtual care delivery model. Amazon also leverages in-house assets to curate an improved member experience, increase accessibility to care through digital solutions (e.g., video, text services) and integrate with other Amazon offerings/products (e.g., grocery, pharmacy, wearables). - Expanding core competencies to healthcare:

Amazon has built on its expertise in logistics and delivery to expand into the pharmacy market with health plan partnerships (e.g., exclusive home delivery service provider for Florida Blue) and direct-to-consumer-facing initiatives with launch of the RxPass program, a prescription drug subscription home delivery service for Prime members.

What Should Health Plans Do?

Create the discipline across your enterprise to continuously monitor your value chain for disruption and ensure alignment to long-term innovation strategy

As these non-traditional players continue their momentum and growth trajectory, they will disrupt the traditional healthcare value chain and care delivery model through investments in technology, member engagement and their ability to deliver care in a manner and in locations that are convenient and accessible to consumers. Health plans must objectively evaluate how they create value for members, employers and other constituents with the intent of creating a multi-year strategy that leverages network, product, clinical programs and ecosystem partnerships to prevent against disintermediation via non-traditional players.

Trend 2: Expansive Adoption of Digital Health Technology and Therapeutics Driving Changes in Care Delivery and Consumer Experience

Driven by consumer expectations, technology advancements, and other macro-level forces (e.g., COVID-19), most healthcare stakeholders, including providers, health plans and consumers, now leverage digital and virtual solutions to address day-to-day healthcare needs. Continued digital and virtual health adoption and innovation are driving changes in care delivery and consumer experience.

As virtual and digital health solutions become further entrenched as table stake capabilities, healthcare companies are expanding their digital footprint beyond traditional offerings (e.g., telehealth for urgent care or primary care) to address high-cost specialty areas. Encouraged by savings realized through virtual primary care and other telehealth offerings, digital solutions that support specialty and chronic conditions may drive significant savings and improve member engagement. High-cost specialty areas have experienced significant growth and investment activity in the digital and virtual space.

For example, digital musculoskeletal (MSK) treatments prioritize outpatient and at home care in lieu of costly and invasive surgical interventions or in-person physical therapy options to improve treatment adherence rates and patient outcomes. Digital MSK companies have seen up to 250% year-over-year enrollment increases since 2019 and hundreds of millions of dollars of investment due to the demand for these solutions. Leading patient-centered digital MSK solution, Hinge Health released its 2022 State of MSK Report indicating that each participant averaged ~$2,200 - $3,500 in medical claims savings per year as a result of non-surgical care. Similar member engagement levels, effectiveness and savings have been found for other digital health solutions focused on highcost specialty areas, such as diabetes, fertility, and cancer.

Vori Health and PRNPT are partnering to bring a hybrid care model with in-person physical therapy and a virtual MSK solution to create a seamless member experience with significant cost savings for plans and employers. Hinge Health recently announced in-home physical therapy house calls to complement its digital MSK offering.

What Should Health Plans Do?

Invest in clinical / care coordination efforts

While digital care delivery models provide an opportunity for cost savings and improved member engagement, plans will need to focus on integration to bridge gaps in care and the member experience throughout the healthcare continuum across both physical and digital mediums. Consumers value flexibility and optionality across the continuum, requiring plans to review their network of virtual and physical offerings and coordinate care. Healthcare organizations should pursue a long-term virtual health growth strategy that not only identifies and enables preferred network providers but also allows selective enhancement of the network’s virtual offerings with well-integrated consumer-directed solutions. This long-term strategy should create a robust ecosystem of digital health solutions that can include external partners where advantageous for plans and congruent from a member experience perspective.

Trend 3: The Industry is Making Meaningful Progress in the Operationalization and Realization of Health Equity

Health equity refers to the principle that all individuals should have the opportunity to experience favorable health outcomes, regardless of demographic, socioeconomic or disability status. Varying health outcomes and disparities require healthcare stakeholders to address the underlying components contributing to unequitable experiences, particularly for people of color and other minorities.

Health equity is not giving the exact same resources to all individuals and expecting the same favorable outcomes. Health equity factors in the “whole person” to address each individual’s unique circumstances impacting his or her health.

Health equity has been prioritized at both the regulatory level (e.g., CMS’ ACO REACH, NCQA’s Health Equity Accreditation) and within individual health plans / systems (e.g., via strategic initiatives, commitments to Board / leadership diversity, value-based programs). In 2019, CMS expanded the range of supplemental benefits that Medicare Advantage (MA) plans could offer to their members. In response, adoption of Special Supplemental Benefits for the Chronically Ill (SSBCI) has been on the rise with tailored offerings such as non-medical transportation and structural home modification.

Some individual plans have also been uniquely progressive in their health equity efforts. In 2021, Blue Cross Blue Shield of Massachusetts (BCBSMA) announced its intent to integrate equity measures into provider contracts and payment programs following its detailed examination of health disparities in its own data. Building off this effort, it has created an Equity Action Community with its 13 provider groups in partnership with the Institute for Healthcare Improvement (IHI) to develop pay-for- equity payments. While health equity has been a common buzzword in years past, health plans have an opportunity to curate, enable and complement their health equity solutions around regulatory actions, unique member needs and their local community to reduce healthcare disparity and improve health outcomes.

What Should Health Plans Do?

Integrate a consumer mindset throughout all facets of your organization while actively measuring the pulse of the consumer

The increasing emphasis on health equity highlights the importance of examining the healthcare experience through the eyes of the consumer, given that the individual experience is heavily influenced by aspects such as race, gender and socio-economic status. Through this lens, health plans will be able to understand where members are experiencing disparities across the entire healthcare journey. To do this effectively, health plans will need to ensure that they are engaging with members in thoughtful, culturally competent ways, empower members with education and digital resources to activate their role in their care journey, provide product offerings that address the full scope of member needs and have a workforce that reflects the diverse background of their membership. Moreover, health plans must ensure they are engaging their community partners and providers along similar priorities through value-based reimbursement models, data sharing and member engagement strategies.

Trend 4: There is a Greater Push to Bring Care Closer to the Home

The idea that consumers seek care closer to the home for both an improved experience and a lower cost is not original. Disruption to traditional sites of care delivery began over a decade ago with varying forms of virtual care (e.g., Amwell, Teladoc) along with a push towards care in alternative, more convenient settings (e.g., CVS’ MinuteClinics, Walgreen’s TakeCare Clinics). This formerly adjacent model of care has now become a priority for health plans, consumers and providers as a result of the COVID-19 pandemic and now includes increasing levels of acuity such as post-acute care and hospital at home.

Health plans, CMS and health systems have abandoned legacy fee-for-service reimbursement arrangements and introduced new, advanced forms of reimbursement for care in the home or in post-acute settings. CMS expanded value-based arrangements tied directly to home health and post-acute services and health plans have not let this go unnoticed. Most notably, MA plans piloted and offered bundles and pay-for-performance arrangements. While value-based arrangements are still in infancy, health plans are deploying them at an increasing rate.

A fragmented and large number of small and mid-sized providers have largely dominated the post-acute care market. However, the tide is beginning to shift as some of the largest healthcare organizations make significant strategic investments in the home health and post-acute markets over the past year (e.g., UHC/Optum-naviHealth, Anthem-myNexus, Walgreens-CareCentrix, CVS-Signify Health, Humana-onehome). While the appetite for mega-deals will likely slow down, mergers and acquisitions and more importantly, advancements and investments in the infrastructure to manage post-acute and home care will continue to be a major health plan focus. For home-based and post-acute care to truly expand in more significant forms, non postacute providers must be willing to disrupt their own business models through diversification. Payers and home-based providers, in turn, need to ensure there is sufficient infrastructure in the form of reimbursement, care coordination, transitional care and patient analytics to fully adopt the promise this form of care provides.

What Should Health Plans Do?

Ensure table stakes solutions are in place while making big bets via investments and partnerships on emerging technology

As a result of COVID-19, most health plans have accelerated their “table stakes” telehealth and home-based care solutions, either through internal capability development or via vendor partnerships. However, as the demand to receive care at home continues, the acuity of level of care that can be delivered safely and effectively at home expands (e.g., hospital at home), and as payment models are introduced by CMS, health plans will likely need to build upon their initial approaches. Given the complexity, investment via partnership may be the most efficient way to obtain these capabilities. Health plans will need to evaluate different partnership solutions and determine how such solutions can be operationalized (e.g., reimbursement / payment structures and ability to process claims for these types of encounters).

Trend 5: Personalized Medicine is Knocking on Health Plans’ Doors

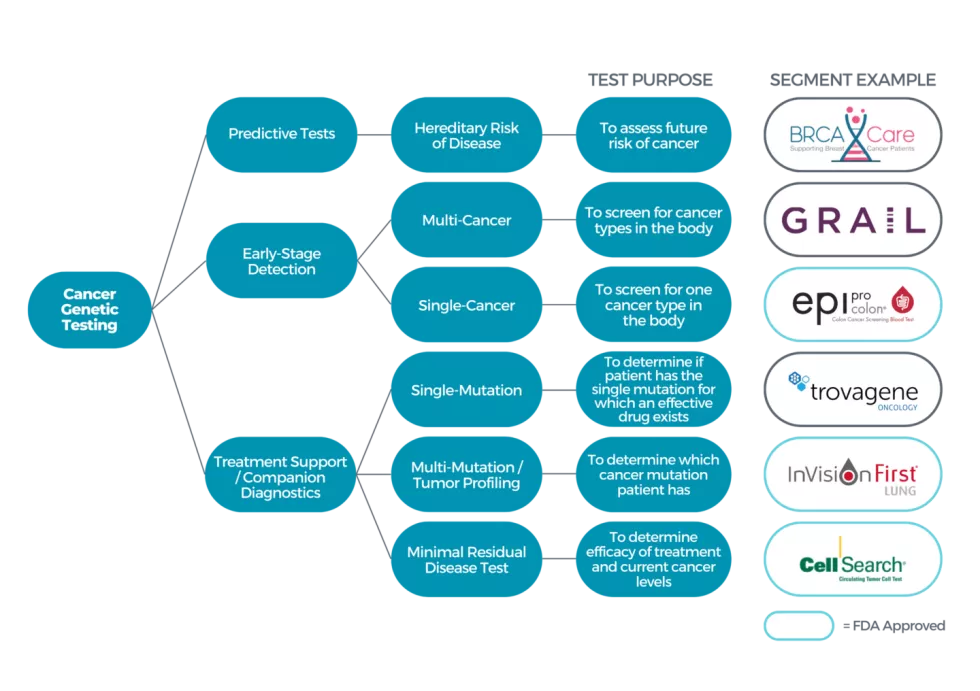

Precision Medicine (“PM”) holds significant promise to find new ways to diagnose, prevent and tailor disease treatments to a specific person with consideration of biological and genetic make-up, environment and daily lifestyle. As of 2020, there were more than 100,000 genetic testing products and 300 personalized medicines in the market and over 40% of precision medicine revenue was related to oncology / cancer care. As seen in the figure below, precision medicine applications in cancer range from pre-diagnoses / predictive tests (e.g., BRCAcare) to detection / diagnosis (e.g., Grail, epi proColon) to treatment support and full treatment therapies (e.g., Yescarta).

Cancer Genetic Testing Market Overview

Figure 1: Breadth of Cancer Genetic Testing Products

Although precision medicine has shown the potential to drastically improve the effectiveness of medical treatment and reduce adverse side effects, insurance coverage varies greatly. The total cost of sequencing per individual human genome has decreased significantly from $100 million to $1,000 from 2001-2018; however, precision medicine therapies prescribed after genomic sequencing tests may carry exorbitant price tags at well over $10,000 per month. For example, the price of FDA-approved Yescarta, a CAR-T cell cancer therapy, costs $373,000 per treatment course.

While health insurance coverage and reimbursement for precision medicine are increasing (e.g., CMS made a national coverage determination for next generation sequencing in 2018), there is not a standardized approach for health plans to make coverage determinations for most precision medicine solutions. Plans may cover precision medicine on an exception only basis, citing clinical utility, evidence, and/or medical necessity as rationale in their decision making. To make these coverage decisions, plans often require additional evidence either through larger scale clinical trials which can be costly and/ or real-world data (RWD) and real-world evidence (RWE) which have variable quality and validity.

Some plans, like Point32Health, view precision medicine as an opportunity to bring innovation and differentiation to their products. Point32Health broke ground as the first commercial health plan to offer Galleri, Grail’s multi-cancer early detection (MCED) blood test, to pilot eligible employees and members. While promising, precision medicine therapies have yet to achieve full scale due to their frequently cost-prohibitive nature. The cost of these therapies often falls upon the consumers—other treatments often lack market awareness and/or coverage by most plans.

What Should Health Plans Do?

Align product offerings around member values/priorities and rethink access and product design

Health plans may face challenges when determining the value of PM due to expensive treatments, lack of FDA approval and / or clinical guidelines established and difficultly quantifying long-term benefits. Plans may be hesitant to cover these treatments unless there is strong evidence of their effectiveness and cost-effectiveness. Despite these challenges, health plans are progressively recognizing the potential of PM to improve patient outcomes and reduce healthcare costs. Some are experimenting with new payment models, such as value-based pricing, to incentivize the adoption of PM. Moreover, the product differentiation opportunities (particularly in MA) may be opportunities to pilot offerings to capture lives while evaluating the effectiveness of the treatments and diagnostics. Finally, plans may find the opportunity to tap into the rich data being collected by the PM provider – partnerships could unlock the full value of PM.

HealthScape Can Help

In 2023, the convergence of topics that were historically emerging reaches greater prominence. Health plans will need to refocus their efforts in the wake of greater variability and uncertainty. We have supported our client partners to develop, design and execute strategies that position them favorably in an increasingly competitive environment.