2022 Medicare Advantage Dental Benefits in Review

Medicare Advantage (MA)—the alternative to traditional Medicare which allows seniors to receive Part A and B benefits through private insurance—continues to rise in popularity. As of April 2022, almost half (46%)¹ of all Medicare beneficiaries are enrolled in an MA plan. Due to the aging population and steady growth in demand, the market continues to experience increased competition with new plans entering the market and existing plans expanding their geographic footprint. Large National plans (e.g., UnitedHealthcare, Humana) and Blue Cross Blue Shield Association Companies alike are exploring strategies to retain and grow their market share by focusing on member experience and offering plans in new geographies. They are competing against provider-sponsored plans and industry start-ups (e.g., Alignment Healthcare, Devoted Health, Clover Health) that aim to disrupt legacy players and gain market share. Medicare Advantage Organizations (MAOs) need to offer effective and targeted supplemental benefits that support holistic care and elevate the member experience to achieve their enrollment targets.

As we highlighted in our previous Executive Brief, offering competitive supplemental dental benefits can help MAOs increase membership while positively impacting overall health outcomes. We have refreshed our previous analysis of the Individual MA supplemental dental benefit market data through 2022 to synthesize new insights and recommendations for MAOs to consider when developing a forward-looking MA supplemental benefits strategy.

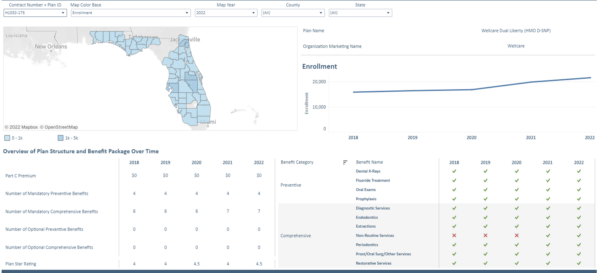

Our analysis is powered by the HealthScape MA Dental Compare product. This product synthesizes five years of CMS dental data and enables plans to analyze dental-specific benefits across service areas, time periods and competitors. Our analyses examine all non-employer group MA plans (i.e., Employer Group Waiver Plans [EGWP] are excluded).

HealthScape’s Medicare Advantage Dental Benefit Compare Tool Examples

Overview

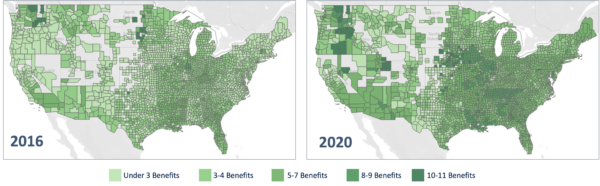

Supplemental benefits are key differentiators for MA plans. Our research suggests that dental benefits continue to grow in popularity as demonstrated by the prevalence of members with dental coverage (i.e., percentage of enrollees with dental benefits) and benefit breadth (i.e., number of benefit categories covered) increasing over time. There are eleven different dental benefit categories between preventive and comprehensive within the MA Plan Benefit Package (PBP). We analyze the prevalence of these benefits across the nation by addressing the inclusion of specific service categories (e.g., periodontics, endodontics, prosthodontics) as well as annual benefit maximums to better understand the expansion of supplemental dental coverage over time. We believe that supplemental dental benefits are table stakes and MAOs that continue to invest in dental as a key component of their supplemental benefits portfolio will be best positioned to attract and retain members.

Section 1

Preventive Dental Benefits Overview

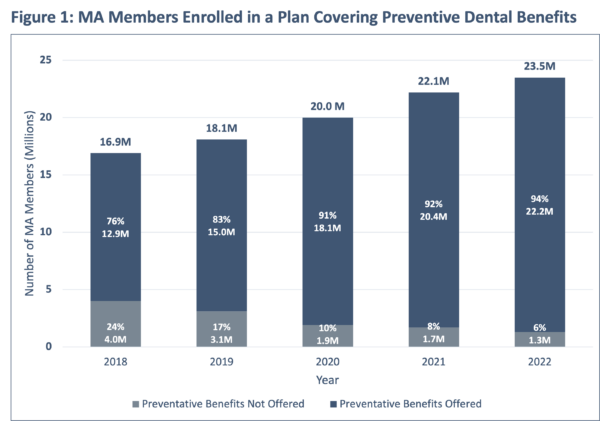

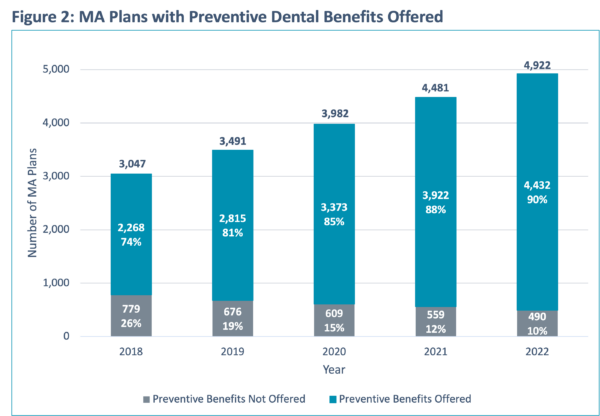

Preventive dental benefits—dental x-rays, fluoride, oral exams, and prophylaxis (cleaning)—are routinely administered services used to lower, or manage, the risk of more serious dental issues. MAOs have offered these benefits to a large majority of MA members since 2016. Nevertheless, Figure 1 demonstrates the continued growth and popularity of these benefits in the last five years. As overall MA enrollment increased by over six million members since 2018, the number of individuals without access to preventive dental benefits reduced by about 75% in the same period.4

When comparing Figures 1 & 2, it becomes evident that the number of MA members in plans with preventive benefits is greater than the proportion of MA plans with preventative benefits. For example, in 2018 the 74% of MA plans providing preventive services accounted for 76% of total enrollment whereas 90% of MA plans providing preventive services accounted for 94% of total enrollment in 2022.

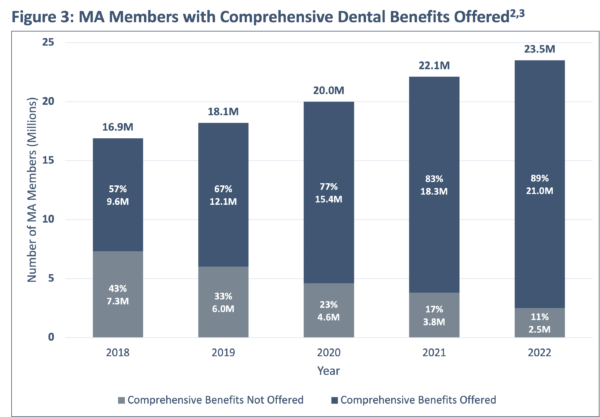

Comprehensive Dental Benefits Overview

Comprehensive dental benefits include diagnostic services, endodontics, extractions, periodontics, oral surgery and prosthodontics and restorative services. These services treat more serious oral healthcare issues and chronic conditions. Figure 3 indicates that in 2018, over half of all MA members had access to comprehensive services included in their benefits; looking forward to 2022, almost 90% of beneficiaries have either Mandatory Supplemental Benefits (MSB) or the opportunity to purchase Optional Supplemental Benefits (OSB) comprehensive dental coverage.6 In the past five years, the number of members with access to comprehensive coverage (via MSB or OSB) has more than doubled from 9.6 million to 21 million members.

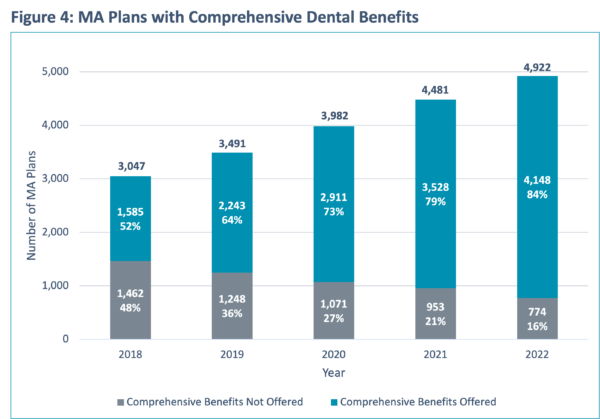

Similar to the preventive dental benefit landscape, Figure 4 illustrates that plans with comprehensive coverage account for a greater share of membership than the proportion of plans that include comprehensive—the 84% of MAOs with comprehensive coverage in 2020 represent 89% of total MA enrollment. This pattern has held each year in the last five years.

Section 2

Deep Dive into Key Service Categories

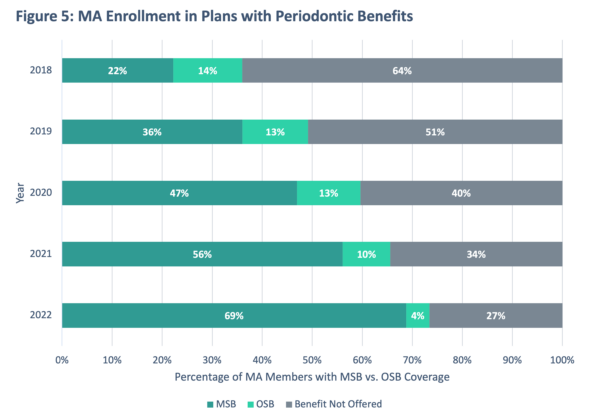

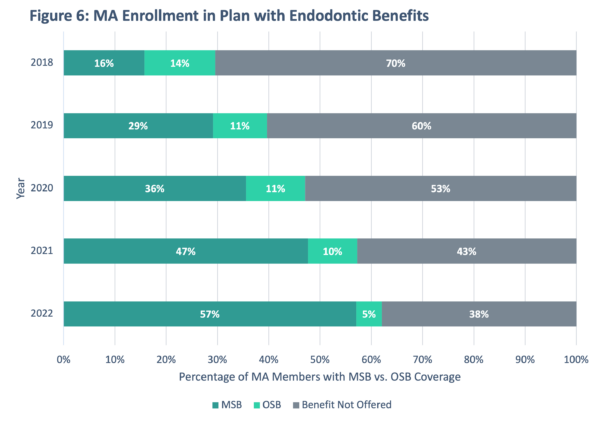

With more and more MA Plans offering both preventive and comprehensive benefits, we took a deeper dive to evaluate whether the prevalence of these benefits also increased over time. We analyzed two common comprehensive benefits (i.e., Periodontics, Endodontics) to examine trends in the offer rate (either as MSBs or OSBs) over the last five years.

Across the three benefits highlighted in Figures 5 and 6, there was a significant uptick in enrollment for plans that covered these additional dental benefits. These expanded benefit categories can help seniors access care that may otherwise be neglected. According to the CDC, two in three adults aged 65+ have some form of gum disease. Expanded benefits like periodontics can help seniors avoid further complex oral health issues that can contribute to adverse effects on their oral, physical and mental health.

Section 3

Budget-Friendly Plans Continue to Grow and Offer Dental Coverage

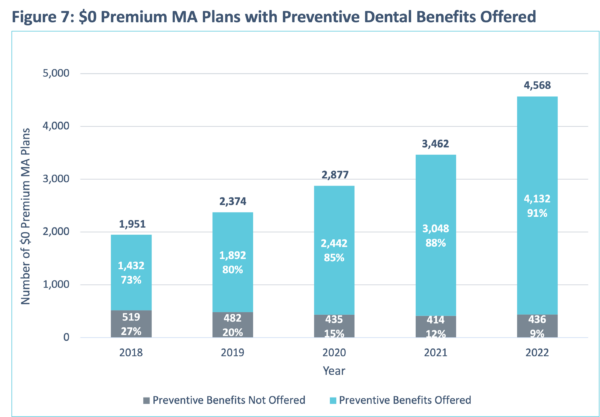

HealthScape conducted an analysis of the prevalence of dental benefits within $0 premium plans. The availability and popularity of these plans has been steadily increasing year over year, with total enrollment in $0 premium plans growing at an annual rate of 18.6% between 2018 and 2022. Figures 7 and 8 show the growth of $0 premium plans that offer preventive and comprehensive benefits, respectively. Even within MA products with lower member premiums, MAOs are prioritizing dental benefits to attract and retain membership.

Section 4

Looking Deeper Into The Benefits

With more MAOs offering benefits across preventive and comprehensive benefit categories, it becomes increasingly important for seniors to be judicious in reviewing plan coverage. MA plans can market coverage within a service category (e.g., periodontics) by covering a small number of actual CDT codes within the category. Savvy shoppers who review the benefit categories as well as other plan details (e.g., the actual CDT codes covered within each category and other service limitations such as annual maximums and frequency limits) will be best positioned to make informed coverage decisions.

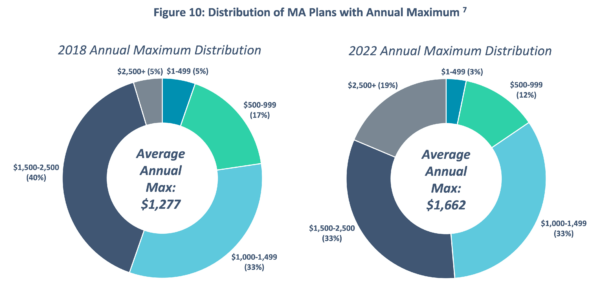

In recent years, the popularity of annual maximums being used as a financial control measure has grown dramatically. Figure 9 illustrates this trend as MA plans with annual maximums have grown from 20% of plans in 2018 to almost 70% of plans in 2022. Figure 10 highlights that the distribution and size of those maximums has also changed between 2018 and 2022, with a 30% increase in the average annual maximum.

Closing Thoughts

As we look to the future of MA, we believe members will expect dental coverage to be a table stakes benefit. Further, we believe that the member experience associated with those dental benefits will also be critical. MAOs should prioritize and fund service categories that include a more complete underlying code set (i.e., not “check the box” with a restricted, limited number of underlying CDT codes). From our perspective, marketing the service category as covered while significantly limiting the actual underlying codes can change the perception of dental benefits from a “delighter” to a “detractor.”

In our next brief, we will detail our perspective on the growing category of Social Determinants of Health (“SDOH”) Medicare Advantage Supplemental benefits. These “new benefits entrants” are foundational for a holistic benefit set focused on improving health outcomes.

HealthScape Can Help

HealthScape brings a “think national, analyze local” approach to dental benefit assessment. We pair our expertise in evaluating and synthesizing macro market forces with local market considerations to enable plans to expand and optimize their geographic footprint and dental benefit design.

Contact Brian Goetsch for more information.