Designing a Competitive Supplemental Dental Benefit for Your Medicare Advantage Members

HealthScape is pleased to introduce a series of Executive Briefings highlighting the importance of supplemental benefits for Medicare Advantage Organizations (MAOs) as they seek to create value and differentiate plan offerings for their beneficiaries. This brief will focus exclusively on exploring the CY 2020 dental benefit offerings across the national market to inform those designing MA plans for 2021. Subsequent Executive Briefs will focus on the evolution of dental benefits and trends in other key benefits (e.g., hearing, vision, Over-the-Counter [OTC]).

Decision makers must understand the current state of supplemental dental benefit coverage in order to make informed trade-offs in future plan design decisions. As context, traditional Medicare does not cover “most dental care, dental procedures, or supplies, like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices.” Medicare Part A (Hospital Insurance) can pay for certain dental services, such as emergency or complicated procedures in an inpatient hospital setting, but this does not cover the most-utilized dental services. Fortunately, MAOs have the flexibility to offer benefits not covered by traditional Medicare, like vision, hearing, or dental. These supplemental benefits are a key value driver for seniors and are leveraged by MAOs in order to attract membership and improve health outcomes.

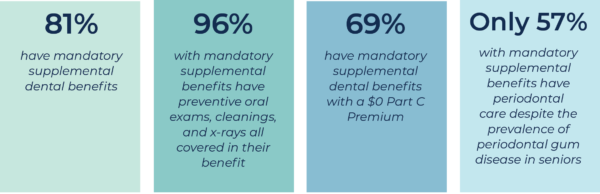

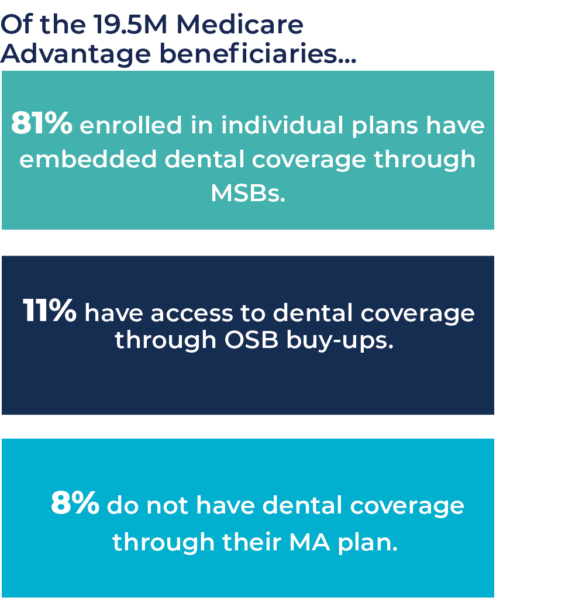

Of Medicare Advantage Beneficiaries:

Offering additional dental care to over 50 million Americans over the age of 65 is particularly important for multiple reasons. First, health plans and providers are increasingly stressing the connection between oral and physical health. Dental health may contribute to or exacerbate certain chronic conditions such as diabetes, coronary artery disease, cardiovascular disease, osteoporosis, and other inflammatory disorders. Second, the popularization of value-based care programs that connect provider payment to quality of care provides further incentives for plans and providers to emphasize dental care for health maintenance. Finally, seniors have significant oral care needs relative to the younger populations, due to an elevated prevalence of tooth decay and loss, periodontal disease, and other geriatric-specific conditions.

HealthScape recommends all health plans pursue the following roadmap when constructing their supplemental benefits portfolio based on 2020 plan design analysis:

- Easy to Understand Benefits – Ensure that your benefit design is easy for seniors to value and understand.

- Benefits that Matter Most to Seniors – Tailor your benefits to meet the oral care needs specific to the senior population.

- Local Market Focus – Benchmark your top local competitors over the past few years and identify opportunities to differentiate.

OVERVIEW OF SUPPLEMENTAL DENTAL BENEFITS

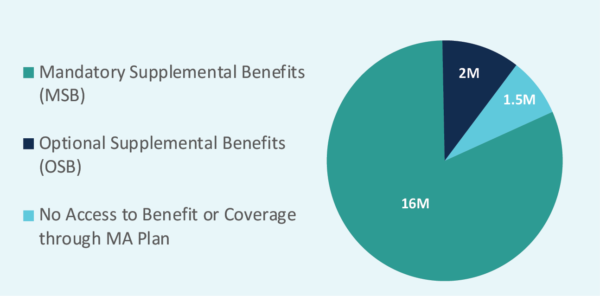

Supplemental dental benefits offered by MAOs are defined as either mandatory coverage or optional, elected coverage. A Mandatory Supplemental Benefit (MSB) is a benefit that a Medicare Advantage beneficiary automatically receives embedded within his or her plan while an Optional Supplemental Benefit (OSB) must be elected and purchased by a beneficiary during the enrollment process for an additional fee. The MSB ensures beneficiaries have coverage for supplemental benefits while the OSB ensures they have access to buy coverage.

Figure 1: MA Enrollment Across Dental Benefit Levels

Notes: HealthScape analyzed supplemental dental benefit information by utilizing CMS-released Plan Benefit Package (PBP) data. Only PBP files from CY 2020 were aggregated. For the purposes of this Executive Brief, the following contracts were excluded: employer group (EGWP) and 1876 Cost, MSA, National PACE, and PFFS individual plans. All figures are rounded.

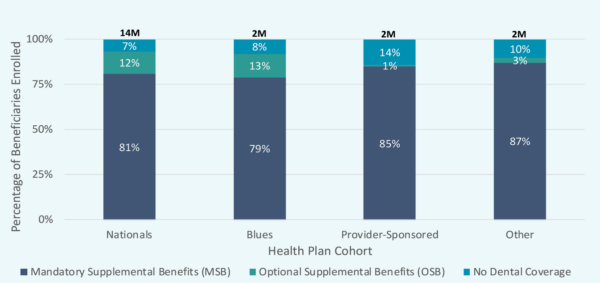

HealthScape evaluated different MAO plan cohorts – Nationals, Not-For-Profit (NFP) Blue plans, Provider- Sponsored, and Other – to determine if there were similar trends when analyzing the usage of MSBs or OSBs. The results show that Nationals and NFP Blue plans use a similar mix of MSB and OSB while Provider-Sponsored and Other category plans rely almost solely on MSBs.

Figure 2: Dental Benefit by Plan Cohort

MANDATORY SUPPLEMENTAL BENEFIT

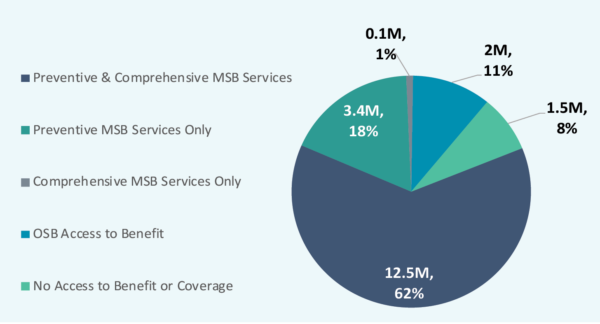

When reviewing the dental benefit offerings, it is important to remember that supplemental dental benefits can be further categorized as preventive or comprehensive. Preventive services include oral exams, cleanings, x-rays, and fluoride treatments typically performed regularly as proactive health measures. Comprehensive services include restorative services (fillings), endodontics (root canals), periodontal treatments, extractions, and prosthetics, among other services. In 2020, of the 16 million MA beneficiaries enrolled in individual plans with dental MSBs, 12.5 million have preventive and comprehensive services covered while 3.4 million have only preventive services covered. A very small number of beneficiaries – around 0.1 million – have only comprehensive services covered.

Figure 3: Supplemental Dental Benefit Segmentation

Notes: Plan Cohort definitions – Nationals: plans offering health insurance to broadest population in U.S.; Blues: plans within Blue Cross Blue Shield Association; Provider-Sponsored: plans owned by a health system, physicians group, or hospital; Other: all remaining health plans.

PREVENTIVE BENEFITS

To remain competitive in supplemental dental benefit offerings, plans should offer MSBs that cover preventive care. The most popular MSBs – oral exams, cleaning, and x-rays – are offered to over 15 million individual MA beneficiaries. Offering these three services as mandatory benefits are “table stakes” when creating an attractive supplemental dental benefit.

Fluoride, covered in MSBs for about 50% of beneficiaries, has typically been considered a dental treatment reserved for those with developing teeth. However, new research indicates that adults with conditions that put them at a higher risk of tooth decay, such as gum disease or the presence of crowns, would benefit from topical fluorides. Offering fluoride as a mandatory supplemental benefit could both positively contribute to beneficiary health and be a differentiator from other plans.

MAOs have a wide variety of plan design features to control the total cost of care for dental services. One such way is to assign a maximum number of treatments for services in a certain benefit period. Treatment limits are extremely common for preventive services given their predictable nature and easy for seniors to understand when comparing benefits.

Choosing the exact treatment quantity depends on local market conditions and a MAO’s comfortability with risk exposure. However, general trends can be gathered from analyzing 2020 market data – oral exams, cleanings, and fluoride treatments are often capped at two treatments, while covering one x-ray is most popular.

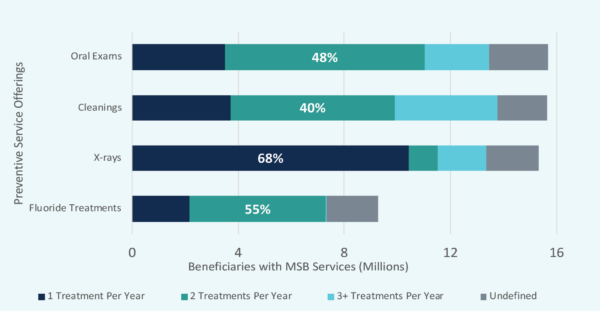

Figure 4: Maximum Preventive Treatments Allowed Per Year

Notes: Focused on MA beneficiaries with at least preventive MSB coverage (~16M)

COMPREHENSIVE BENEFIT STRATEGY

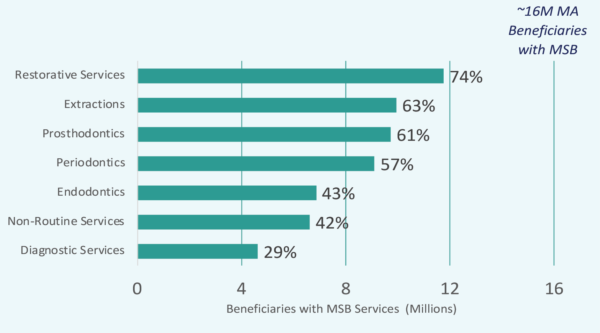

MAOs must focus analyses and available benefit dollars on investment in comprehensive dental benefits to maximize differentiation in the competitive MA market. Comprehensive MSB services are more expensive and generally provided less frequently than the preventive MSBs. HealthScape’s analysis finds that some combination of restorative services, extractions, prosthodontics, and periodontics are covered for about half of all MA beneficiaries with MSB coverage. However, a more in-depth look is needed at each MAO’s local market to determine which of these services are most frequently offered by their competitors while also considering the value to beneficiaries.

Covering periodontal services for seniors is an effective tactic to both differentiate from other MAOs and offer needed care. Over two-thirds of adults aged 65 or older have gum disease and evidence suggests a connection between periodontitis and a range of comorbidities, such as cardiovascular disease and Type 2 diabetes. However, periodontics as a covered MSB service is only offered to a little over half of MA beneficiaries.

Figure 5: Scope of Comprehensive MSB Services

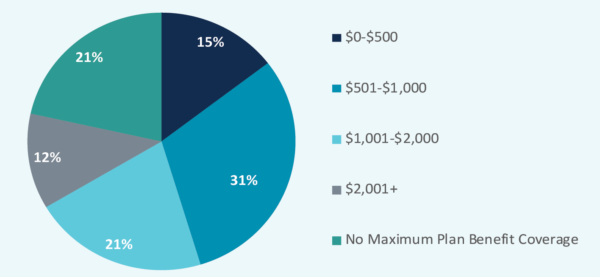

The most commonly used feature to manage costs of providing comprehensive services is the maximum plan benefit coverage amount – a maximum dollar amount a MAO will pay towards the cost of dental care within a defined period. This feature’s value is easy for seniors to recognize when comparing plans during the shopping process. For example, a beneficiary can quickly understand that “I get $1,000 of benefit coverage from this plan.”

MA beneficiaries with comprehensive MSB services include maximum plan benefit coverage amounts almost 80% of the time. These amounts range from a few hundred dollars to over $2,000 in several instances. Plans that only offer preventive MSB services rarely utilize maximum plan benefit coverage amounts, since the exposure to financial risk is less for preventive services than it is for comprehensive services. Hence, our analysis focuses on beneficiaries in plans with at least MSB comprehensive services.

Figure 6: Beneficiaries Enrolled By Maximum Plan Benefit Coverage Amount

OTHER PLAN DESIGN CONSIDERATIONS

Scope of Dental Benefits within Part C Premium Ranges:

As MAOs create their supplemental benefit offerings, plan design must consider financial components. Numerous factors contribute to the pricing of a Medicare Advantage plan. As such, this paper will only focus on the relationship between Part C Premium and the access to dental benefits.

A large majority of seniors who place value on supplemental benefits can find plans with a $0 monthly Part C premium.

Figure 7: Dental Coverage by Part C Premium

Notes: Figure 7, Focused on MA beneficiaries with comprehensive and preventive MSB coverage

Flexibility in the MA Uniformity Requirements:

Given new supplemental benefit flexibility from CMS in 2019, Medicare Advantage plans can expand the types of supplemental benefits to chronically ill enrollees in a non-uniform way. This new provision may offer the ability of plans to provide more comprehensive dental coverage to these members for dental disease treatment if the patient has a co-morbid medical condition that might reasonably benefit from these services, such as cardiovascular disease. Plans should not overlook the opportunity to explore savings of medical expense, such as avoidable emergency department visits or even hospital admissions by encouraging treatment of dental disease through such supplemental coverage for qualified beneficiaries.

Shifts in Consumer Behavior:

With recent changes in the Medicare Open Enrollment Period (OEP) and the expected disruption in the post-COVID-19 Annual Enrollment Period (AEP) this fall, plan shopping and beneficiary switching rates will elevate to new levels. Competitive levels of annual benefits are an important consumer consideration. Plans should look to the high visibility of supplemental dental coverage to not only attract new members but also ‘bubble wrap’ their existing MA membership from competitive shopping and switching.

Next Steps for 2021 Plan Design

The clock is ticking for MAOs to incorporate competitive benefits into their 2021 offerings. Given CMS’s recent release of favorable CY 2021 Medicare Advantage Capitation Rates, MAOs can promote the expansion of supplemental benefits. HealthScape’s Cary Badger further contends that MA beneficiaries will switch to plans with richer benefits due to the insecurities created by COVID-19.

Designing differentiated plans with robust benefits to support seniors’ dental and overall health is critical.

HEALTHSCAPE CAN HELP.

Creating differentiated supplemental benefit offerings across the national market is critical, especially in MA plans for 2021. From insight to execution, HealthScape supports health plans design the most effective benefits year after year. Reach out to see how HealthScape can help you understand your local market’s preferences and industry trends to stay competitive.

Contact Brian Goetsch at (312) 995-4102 or bgoetsch@healthscape.com for more information.