YOUR PROVIDER DATA QUALITY PROBLEM MAY BE BIGGER THAN YOU THINK… AND IT COULD BE GETTING WORSE

Under normal circumstances, inaccurate provider data presents significant operational and financial challenges for health plans. In 2020, these problems have been exacerbated across the healthcare ecosystem. Provider practices and hospital systems have been pushed to their operational limits; resource-constrained hospitals have onboarded additional clinicians and the use of technology-enabled alternative care delivery services, like telehealth, has skyrocketed. It is no surprise that administrative processes (e.g., updating demographic data for plan use) have not been a high priority.

In this brief, we note a number of accelerating and emerging industry trends that are occurring in parallel. These trends will continue to amplify the widespread problems with provider data quality and intensify the resulting operational and financial impacts to plans and the healthcare industry at large. If plans do not start addressing the problem soon, it will be that much more difficult to remediate in the future.

Provider Data Management (PDM) is not a new concept for plans. The industry has attempted to address this issue for decades, with a conservative estimate of spending nearly $2.1 billion annually. Yet even with consistent year-over-year investments, many have failed to materially improve their PDM capabilities. Case in point: results from the most recent Centers for Medicare & Medicaid Services (CMS) secret shopper program revealed that more than 95% of all audited Medicare Advantage (MA) plans faced issues with their provider data that were significant enough to warrant a designation of “non-compliance.”

Why is This Problem So Difficult to Solve?

- Providers do not have the time and administrative capacity to deliver timely and accurate updates to their numerous plan partners (and there are no regulatory or contractual requirements to do so).

- Plans do not fully understand the breadth and magnitude of the impact to their organizations, which results in lack of adequate funding for and prioritization of real solutions.

The first issue is critical; however, in many cases it is outside a typical health plan’s control. Absent universal requirements for data quality and submission, which will likely not be in place for several years, plans are increasingly recognizing the need to develop creative “workarounds” to incentivize provider partners and ease their administrative burden.

We believe the second issue requires immediate focus. In this paper, we will discuss the rationale for why the classic “business as usual,” siloed approach to PDM poses significant business risk moving forward and outline strategies for plans to make the case for immediate change.

Why Now? Accelerating and Emerging Impacts of Provider Data Quality

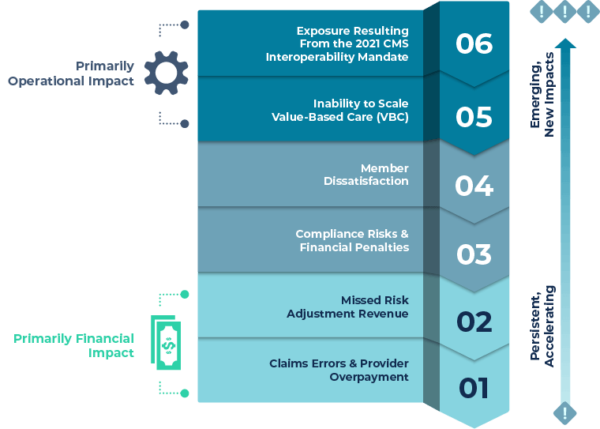

Most plans are aware of the ways in which provider data quality impacts compliance risk, claims accuracy, risk adjustment and member satisfaction. Each of these impacted areas should be of greater concern for plans moving into 2021—for a variety of reasons we describe below in Figure 1. In addition, emerging market forces, such as transformative care delivery models and regulatory mandates, will result in incremental risks and impacts—all of which can be directly tied to provider data quality. Any one of these issues presents a compelling business case to resolve provider data quality issues, but when we analyze the aggregate potential impact of them all, the case becomes overwhelming.

Based on our analysis, a mid-sized health plan with 3 million members could potentially be at risk for more than $100M in lost revenue and compliance penalties—in a single plan year.

In this paper, we will explore the accelerating impacts of provider data quality and discuss opportunities to address them at the enterprise level.

Figure 1: Impacts on Health Plan Performance

1. Claims Errors & Provider Overpayment

20-30% of all claims do not auto-adjudicate, with an estimated 25% of those attributed exclusively to provider data quality issues. For a plan with 4 million annual claims, costs to manually resolve claims errors could exceed $20M.

As part of a recent PDM impact assessment conducted with a mid-sized health plan, we found approximately $15M in overpayment due exclusively to errors with provider specialty or affiliation designation.

![]() As networks become increasingly complex and providers work across multiple specialties and practice locations, the rate of errors and lost dollars in overpayment will accelerate exponentially. Plans will simply not be able to keep up with the volume of changes to their provider records.

As networks become increasingly complex and providers work across multiple specialties and practice locations, the rate of errors and lost dollars in overpayment will accelerate exponentially. Plans will simply not be able to keep up with the volume of changes to their provider records.

2. Missed Risk Adjustment Revenue

One of our clients, a large single-state plan, reported that in 2018, it traced more than $120M in un-recoverable risk adjustment revenue to its provider data quality issues.

![]() With increasing regulatory scrutiny on risk adjustment practices, plans must be hyper-focused on compliant and defensible processes for validation of missing diagnosis codes—missing or inaccurate provider data creates a huge barrier to effective risk adjustment processes.

With increasing regulatory scrutiny on risk adjustment practices, plans must be hyper-focused on compliant and defensible processes for validation of missing diagnosis codes—missing or inaccurate provider data creates a huge barrier to effective risk adjustment processes.

3. Compliance Risks & Financial Penalties

Historically, the biggest area of focus for many plans’ PDM initiatives has been the public-facing provider directory. Directory inaccuracies have been a longstanding source of frustration for regulators, plans and members. CMS and some state regulatory agencies appear to be losing patience with the industry’s inability to maintain accurate data and present it to members as they shop for coverage and seek care. The stakes are getting higher and financial implications could be devastating for plans that do not resolve known issues.

![]() As of 2018, CMS revised its penalties for inaccuracies in MA plans’ provider directories. MA plans could face as high as $25K per beneficiary per year for egregious error rates while federal exchange plans could face fines of up to $100 per beneficiary per year for data issues. While it is unlikely the $25K penalty will be enforced in 2021, plans should take action now to prepare for potentially overwhelming penalties as soon as 2022.

As of 2018, CMS revised its penalties for inaccuracies in MA plans’ provider directories. MA plans could face as high as $25K per beneficiary per year for egregious error rates while federal exchange plans could face fines of up to $100 per beneficiary per year for data issues. While it is unlikely the $25K penalty will be enforced in 2021, plans should take action now to prepare for potentially overwhelming penalties as soon as 2022.

4. Member Dissatisfaction

Healthcare consumers frequently cite the inability to quickly and easily identify in-network providers as a source of confusion and frustration. A recent survey by the American Medical Association (AMA) and LexisNexis Risk Solutions finds that more than 50% of providers see patients every month who believe they are seeking care from an in-network doctor, when in fact the physician or practice is actually out of network. Members who decide to proceed with visits or services with out-of-network providers are very often shocked when they later receive bills for their out-of-pocket costs (either from the provider directly or via the plan). This “surprise billing” inevitably results in complaints and billing disputes that can take months to resolve.

![]() As the weighting for patient experience/complaints and access measures increases from 1.5 to 2 for the 2021 plan year, member satisfaction will play a greater role in determining overall MA payments moving forward. Plans will be at a significantly greater risk for MA revenue reduction in 2022 if their provider directory errors result in member dissatisfaction and negative survey responses.

As the weighting for patient experience/complaints and access measures increases from 1.5 to 2 for the 2021 plan year, member satisfaction will play a greater role in determining overall MA payments moving forward. Plans will be at a significantly greater risk for MA revenue reduction in 2022 if their provider directory errors result in member dissatisfaction and negative survey responses.

5. Inability to Scale Value-Based Care (VBC)

Transparency and trust between plans and providers are the foundation on which value-based care agreements are built; yet alignment on performance-based measurement and progress reporting against contractual terms continues to be a stumbling block even for the most agreeable of partners. In a VBC arrangement that relies less on traditional claims and more on outcomes, accurate provider rosters and resulting member attribution are the essential building blocks of performance measurement and defensible financial reconciliation.

![]() Plans looking to expand into more complex and sophisticated VBC reimbursement models require strong provider data to enable performance measurement, payment reconciliation, and provider documentation expectations. Absent accurate provider data many plans resort to operational workarounds, which are wrought with human error and are not scalable as organizations attempt to move a greater percentage of their contracts to shared risk models.

Plans looking to expand into more complex and sophisticated VBC reimbursement models require strong provider data to enable performance measurement, payment reconciliation, and provider documentation expectations. Absent accurate provider data many plans resort to operational workarounds, which are wrought with human error and are not scalable as organizations attempt to move a greater percentage of their contracts to shared risk models.

6. Exposure Resulting From the 2021 CMS Interoperability Mandate

The CMS Interoperability Rule (effective July 2021) will require regulated plans to make provider directory information publicly available via a standards-based application programming interface (API). While internal IT departments are preparing technical data exchange infrastructure and capabilities, the business functions are still taking a “business as usual” approach to managing their directory data, which we believe is a significant missed opportunity.

![]() Presenting inaccurate data to a larger number of external stakeholders with enhanced scrutiny will undoubtedly expose underlying data quality problems and could create a reputational and competitive disadvantage for plans with existing PDM challenges. For these reasons, plans can no longer defer building a comprehensive strategy to address mission-critical provider data management problems.

Presenting inaccurate data to a larger number of external stakeholders with enhanced scrutiny will undoubtedly expose underlying data quality problems and could create a reputational and competitive disadvantage for plans with existing PDM challenges. For these reasons, plans can no longer defer building a comprehensive strategy to address mission-critical provider data management problems.

WHERE DO WE GO FROM HERE?

We believe there are two critical steps plans should take now to accelerate provider data quality impacts and risks:

1. Quantify the Comprehensive Impact Across the Enterprise

In order to shift the dialogue from “we’ve got this under control” to “this investment is mission-critical,” we recommend quantifying and aggregating all risks, costs and opportunities to represent total organizational impact. Financial losses and unnecessary or redundant administrative costs are spread across the entire organization, often appearing as decreased revenue or as expense line items within departments (e.g., IT, network management, claims processing, risk adjustment, customer service, care management). As a result, the underlying issue is often underestimated and considered to be part of the “normal cost of doing business.”

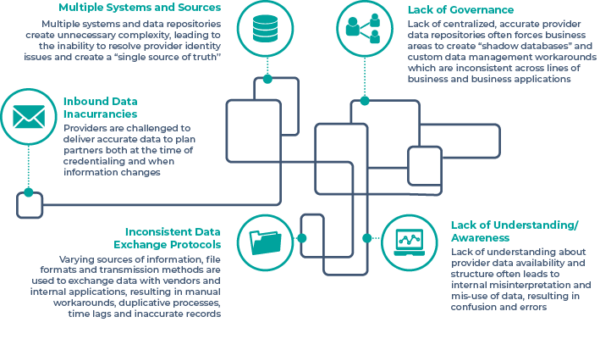

2. Diagnose Root Cause Problems and Make the Case for Change

While every plan is different, we have observed five root causes and capability gaps (Figure 2) that typically contribute to PDM quality issues:

Figure 2: PDM Quality Challenges and Capability Gaps

Solving for these root cause problems typically involves investments in a defined set of capabilities:

![]() Build, or refine, a “Single Source of Truth” for provider identification and demographic data

Build, or refine, a “Single Source of Truth” for provider identification and demographic data

![]() Implement a Master Data Management solution by developing business rules / algorithms to resolve identity issues

Implement a Master Data Management solution by developing business rules / algorithms to resolve identity issues

![]() Standardize (or build centralized processing for) data exchanges between external vendors and internal systems

Standardize (or build centralized processing for) data exchanges between external vendors and internal systems

![]() Deploy a solution to validate and cleanse “inbound” provider data (may require external partnership)

Deploy a solution to validate and cleanse “inbound” provider data (may require external partnership)

![]() Extend and enhance data governance and stewardship programs that are already likely to exist for member, claims and other data domains

Extend and enhance data governance and stewardship programs that are already likely to exist for member, claims and other data domains

The investment required to implement and manage comprehensive PDM capabilities is significant and will require strong executive-level sponsorship and a multi-year technology and operational commitment. That said, there has never been a more critical time to make the case for these strategic investments. The accelerating cumulative financial and administrative impacts— combined with amplified reputational and compliance risks—present an overwhelming case for change.

HEALTHSCAPE CAN HELP.

Whether your organization is in the early stages of building your case for change, or you are well on your way to addressing and enhancing your PDM capabilities, HealthScape has the practical knowledge and deep expertise to support you in your journey towards cultivating a strong and sustainable PDM practice.

Contact HealthScape for more information.