Section I: Introduction

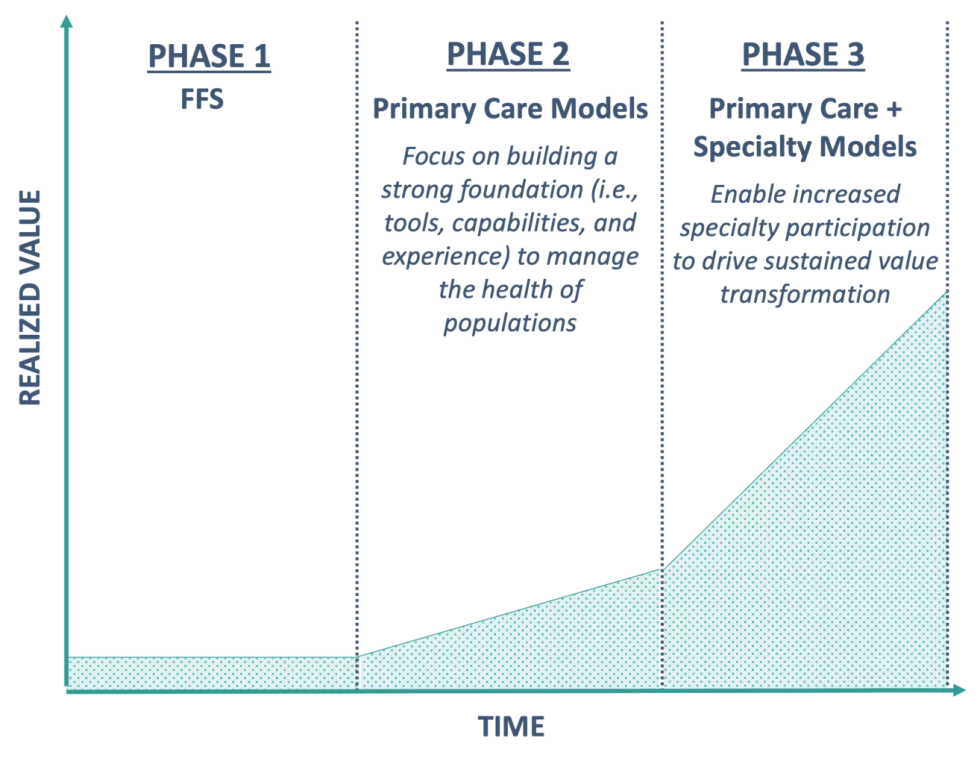

Over the past decade, the value movement in healthcare has grown and evolved. Driven by the development and adoption of primary care-led models (e.g., patient-centered medical homes, accountable care organizations or ACOs), payers have experienced a significant shift in their engagement and contracts with providers.

Primary care models have become the foundation of how payers and providers operate in the value-based healthcare (VBHC) space. As a result, primary care practices are steadily gaining the necessary tools, capabilities, and experience to manage the health of populations and, in some cases, accept overall accountability for cost and quality.

While a value-based primary care foundation is essential, the growth of primary care-based models has hit a saturation point, as evidenced by a plateauing in the number of Medicare ACO contracts starting in 2018. Despite high levels of market adoption leading up to 2018, this plateau is likely driven by inherent limitations associated with primary care-based models. These limitations include:

- Limited Capacity to Manage Polychronic Members: Primary care physicians (PCPs) are less able to manage the health of polychronic members without very strong engagement from specialists. Without strong specialist engagement and coordination, up to 90% of U.S. healthcare spend attributed to those with chronic and mental health conditions is not being effectively managed.

- Overly Broad Populations Under PCP Management: Current models require PCPs to manage an extremely wide array of clinical risk, from very healthy members to members with very high complexity. The breadth of the clinical risk included in populations PCPs are asked to manage drives significant variability in outcomes, requiring very large populations to achieve actuarial significance. The large population requirement then creates challenges in engaging smaller practices.

- Lack of Coordination Between Specialists and PCPs: Payers continue to struggle with empowering risk-bearing PCPs with the actionable data and information necessary to inform clinical interventions and optimize referral patterns to efficient specialists, particularly when those services are delivered outside of a singular system of care.

To address these limitations, future models must enable a significant increase in specialist participation. This paper will outline the value of pursuing specialty care models, associated challenges, as well as past and ongoing efforts in the space. It will also introduce a framework to support payers in taking a portfolio-based approach to deploying specialty care models to minimize abrasion with existing primary care-based models.

Understanding these insights is critical, as the expansion into specialty VBHC is happening now. Payers must be prepared to react to emerging opportunities and harness innovation in order to maintain leading VBHC portfolios as the industry evolves.

Section II: Defining the Specialty Care Opportunity

ACOs and other primary care-based models lack clear opportunities for specialist participation, hindering effective alignment of clinical and financial incentives and effective care coordination. We believe the next round of innovation and growth in the value-based healthcare space will occur as health plans and providers seek to layer specialist-centric models onto existing Primary Care-centric foundations.

Figure 1: Implementing Specialty Care Models to Drive Long-Term Growth (Illustrative)

In doing so, both payers and providers realize the following benefits:

Enhanced patient management and engagement: The average Medicare FFS patient visits two PCPs and five specialists annually. Therefore, the most significant opportunity to enhance patient engagement is with specialists. Engaging specialists directly will facilitate greater efficiencies in specialist-directed care and improved management of patients who do not have an ongoing relationship with a PCP.

Increased specialist accountability: Leaving specialists out of value-based contracts creates a lack of accountability; if specialists provide care to patients who are not attributed to them, there is little to no incentive to control costs. Specialist care models will drive necessary collaboration and engagement between all stakeholders.

Improved financial and clinical outcomes: The likelihood of success for value-based contracts increases due to the benefits outlined above. Given that the vast majority of healthcare costs are in specialty care, there is a significant opportunity to reduce the total cost of care in a meaningful way. From a quality perspective, specialists are better positioned than PCPs to improve patient experience and outcomes.

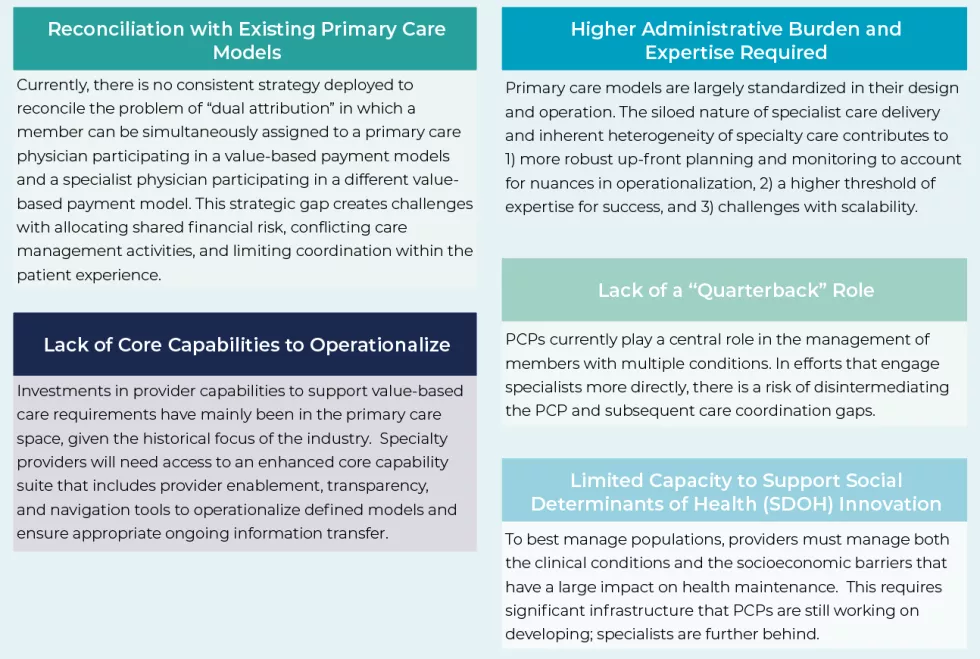

Section III: Challenges with Specialty Care Models

Given the long-standing focus on primary care models and inherent heterogeneity of the specialty market, payers and providers seeking to pursue specialty care value-based payment models must understand and address several challenges:

Section IV: A Look Back at Specialty Care Model Efforts

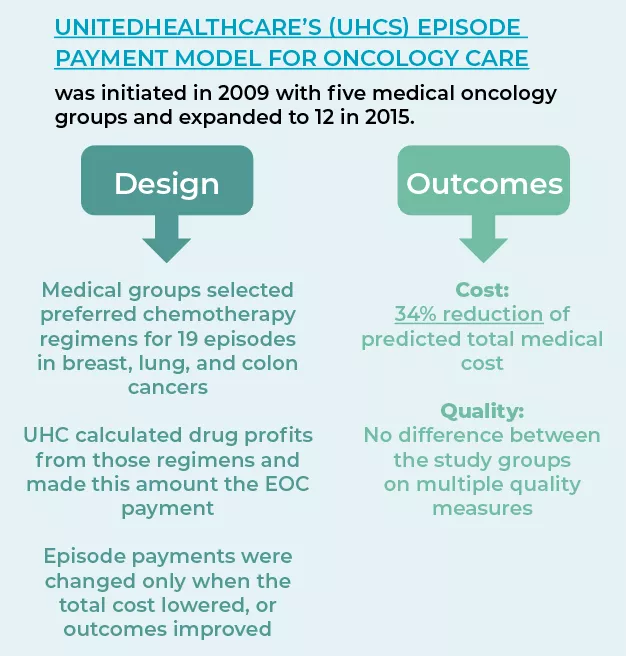

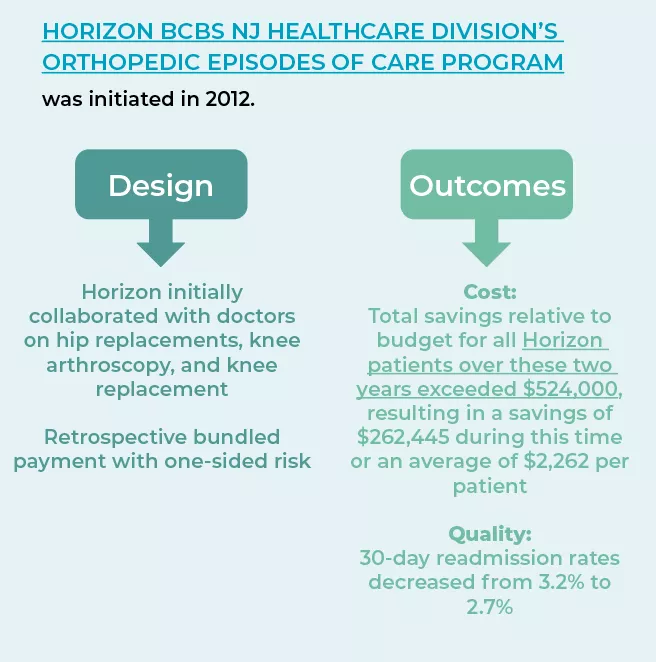

The range of alternative payment models (APMs) for specialty care currently deployed in the market is fairly limited. Specialist assumption of downside risk is also exceedingly rare. The most common approach to date is episodic bundled payments. Under a bundled payment model, providers (typically specialists) and healthcare facilities are provided a set budget to manage all aspects of care during an episode of care (EOC); episodes are tied to a specific clinical condition. The CMS Innovation Center (CMMI) drove development and testing of these models through their Bundled Payment for Care Improvement (BPCI) Initiative which ran from 2013 to 2017 and BPCI Advanced (BPCI-A) which started in 2018 and is ongoing. Forty-eight condition episodes were tested under BPCI, of which the Comprehensive Joint Replacement bundle (CJR) became the most popular and successful. A JAMA study published in 2017 found that CJR saved taxpayers $5,577 or 20.8% per joint replacement care episode for 3,942 patients. The government’s commitment to bundles, as evidenced by the implementation of BPCI Advanced, has driven private payers and large employers to also pursue bundled payment arrangements.

However, meaningful and sustained success via these models has been elusive. Early results of BPCI and BPCI-A have been mixed. Despite participants reducing average episode payments in 7 out of the 13 clinical episodes analyzed over the first ten months of BPCI Advanced, Medicare experienced an estimated net loss of 2.4% after accounting for reconciliation payments made. These outcomes may be due to several factors: 1) flawed target setting or payment incentive methodology, (2) too short of time frames for the long-term specialist engagement required, or (3) premature evaluation. Future efforts will require a more coordinated, informed approach to model design in order to be successful.

Private payer efforts tend to disproportionately focus on orthopedics, cancer, and select cardiovascular procedures for both Commercial and Medicare Advantage members. Despite numerous failures, these programs have also had notable successes (see below):

Figure 2: Successful Episode of Care Models

Section V: Looking Ahead to Value Transformation in Specialty Care

The expansion into VBHC is actively happening across specialties, frequently with significant financial backing from investors. Payers should expect interest in VBHC from multiple provider types and be prepared to react to these opportunities.

HealthScape is actively engaging with players across the healthcare spectrum to identify best practices for mitigating challenges identified in Section III, particularly reconciliation with existing primary care models. A key takeaway from these collaborations is that payers need to develop and deploy specialty care models in a coordinated fashion. Considering a new specialty care program as part of a broader value portfolio, rather than in a silo, helps to mitigate unintended consequences upon implementation (e.g., multiple attribution, dilution of impact). This in turn mitigates the need for complicated or confusing design changes to existing models.

To help payers get to a portfolio view of their VBHC models that facilitates specialty care model development, we propose the following framework:

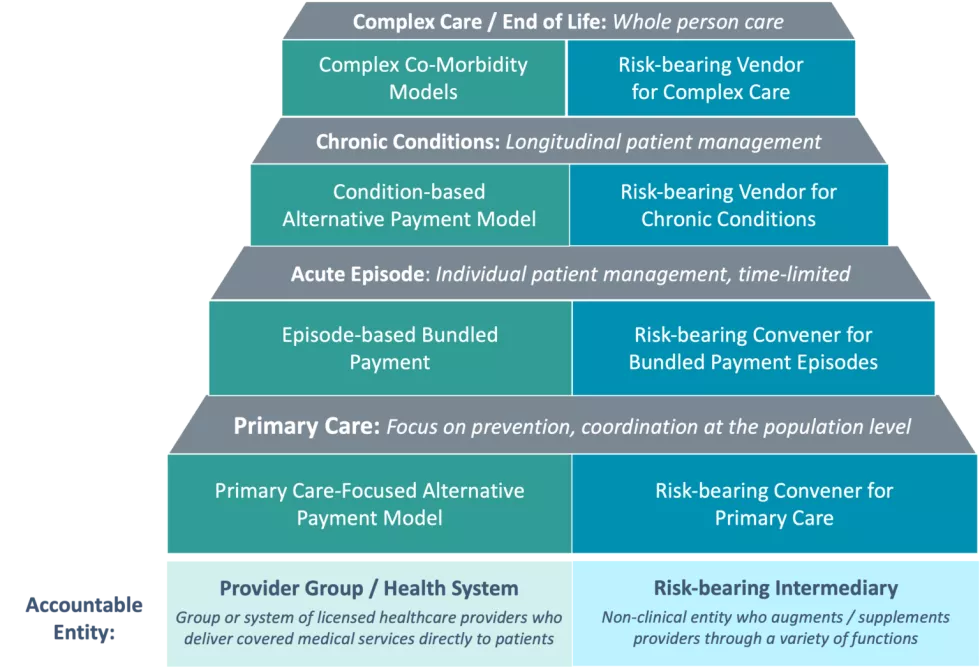

Figure 3: Portfolio Framework for Specialty Model Identification

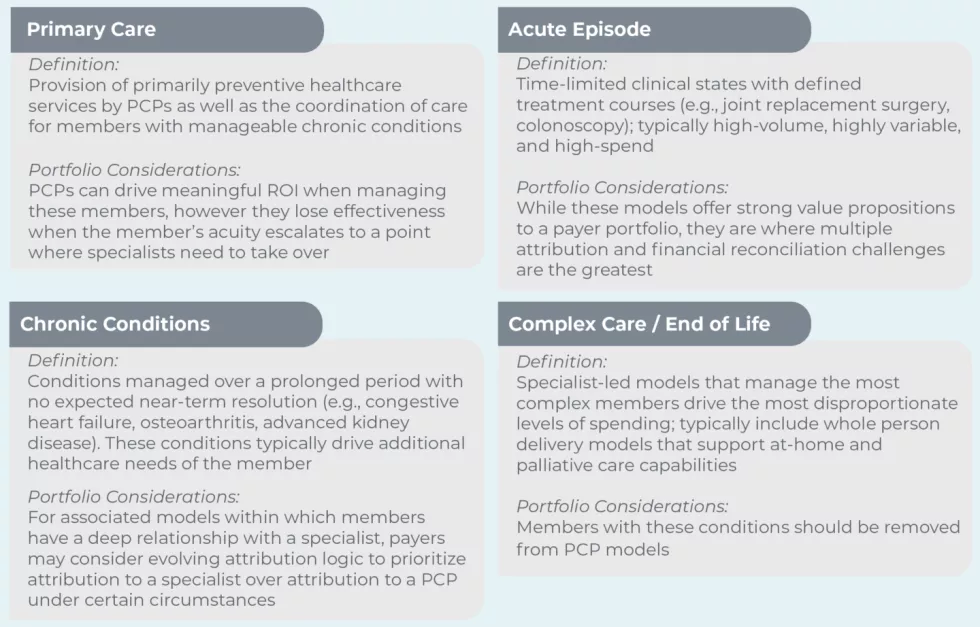

The four gray steps represent the spectrum of types of care from low acuity (primary care) to high (complex care / end of life). The majority of payers who have started to expand into specialty care programs have focused on acute and chronic conditions. See below for detailed definitions of each step, and considerations for plans as they advance their VBHC portfolio beyond the primary care foundation to include more specialty care programs.

The execution of models related to each type of care can also be bifurcated by the accountable entity. Provider groups / health systems typically act as the accountable entity in cases where specialist risk tolerance is moderate to high, and risk-bearing intermediaries can support when specialist risk tolerance is lower.

Section VI: IMPLICATIONS & CONCLUSIONS

When looking to develop specialty care models, payers must take a portfolio-based approach to ensure success. Specifically, payers must:

- Define the vision, goals, and scope of each model in their value portfolio

- Identify which mix of providers create the greatest opportunity for overall portfolio success

- Select the specific inclusion, exclusion, and prioritization criteria for attributing members to each model

- Design new value-based payment models that do not inadvertently disincentivize risk-bearing entities engaged in existing models

- Rollout technology that enables PCP and Specialists to co-exist and succeed under new models.

HealthScape is committed to collaborating with both payer and provider organizations to understand best practices for each of these steps and accelerate the shift to specialty care models. Leveraging insights from these relationships, follow-up papers in this series will further unpack specialty care concepts and considerations. The next paper will dive deep into the specialty care model types introduced within Figure 3 and best practices for model design and operationalization.

HealthScape can help.

HealthScape invites players across the healthcare landscape to discuss their efforts around value transformation in specialty and to collaborate with us on developing strategies and solutions. Please contact HealthScape’s Value-Based Healthcare lead Michael Ferson to discuss further.

Contact Mike Ferson f or more information.