Employer Group Waiver Plans (EGWP) are often an untapped market within a comprehensive Medicare Advantage (MA) and Senior Market strategy for many regional health plans. Group retiree markets are changing due to pressure on retiree benefits. Refreshing your group retiree market strategy may yield a significant Medicare market opportunity for regional MA plans. Here’s why.

WHY REFRESH YOUR GROUP RETIREE STRATEGIES?

The Senior Market is widely recognized as a significant and continuously growing market. The Congressional Budget Office estimates that there were approximately 58 million Medicare beneficiaries in 2017, and this number is estimated to grow to over 75 million in the next ten years as more Boomers age into the program—approximately 10,000 Boomers turn 65 each day. Medicare enrollment is rising at a rate not seen in the history of the program and will continue for the next 13 years. Plus, according to our MA Market Spotlight tool, one in three beneficiaries is enrolled in MA, and in some states, MA penetration is greater than 50%. These highly penetrated states are still experiencing consistent growth.

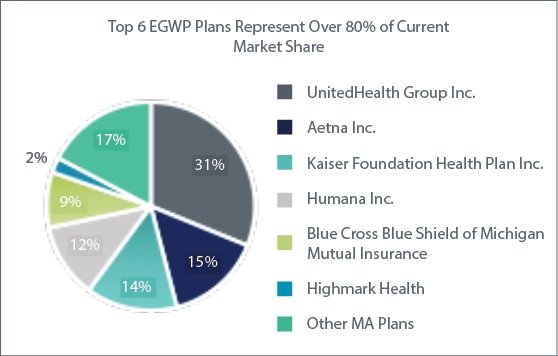

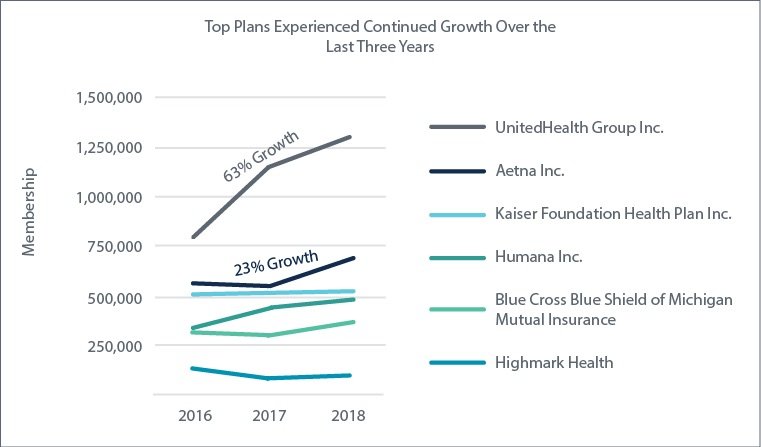

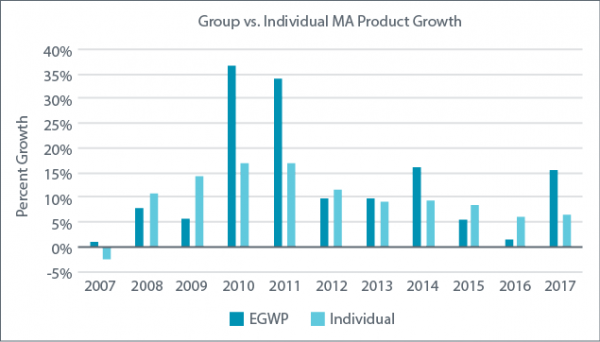

This growth trend manifests itself in group retiree plans as well. According to Market Spotlight data, in 2017, one in five MA beneficiaries was enrolled in an EGWP, and this market is growing disproportionately to the individual MA market. Why? Even though retiree coverage is decreasing nationally, employers are actively seeking new retiree solutions to help control costs, and MA plans can offer greater value to employers through managing care savings not available in group Medicare supplemental plans. As a result, employer group retirees enrolling in MA grew over 15% from 2016 to 2017, according to Market Spotlight data. These customized plans appeal both to the beneficiary as well as employers looking to contain costs for the short and long term, particularly within public employer markets.

KEY DRIVERS OF GROWTH IN EGWP PRODUCTS

Much of recent EGWP growth can be attributed to PPO group MA products, which grew by nearly 25% from 2016 to 2017, according to Market Spotlight data. This growth is due to:

- Diminishing of the RDS Drug Subsidy tax incentives for employers*

- Escalating costs of rich Medicare Supplemental Benefits (especially Rx) for retirees

- The ability to customize MA EGWP benefits to engage retirees

- Strategic relationships with Provider systems that can be leveraged through group MA retiree coverage

*With passage of the Affordable Care Act (ACA), RDS payments are no longer excluded from an employer’s taxable income.

The Group Retiree Market is more efficient, yielding significant benefits for health plans

For regional MA plans, this interest from employers represents an additional opportunity for efficient growth within their MA book of business. Whereas traditional individual MA products require significant investment in grassroots marketing, sales efforts, and advertising budgets—and with a relatively short Annual Enrollment Period for recruitment of beneficiaries—group retiree markets share the efficiencies of employer group member acquisition costs. EGWP plans can also customize benefits and enrollment periods under CMS waivers. (See Medicare Managed Care Manual, Chapter 9, Section 20.)

GROWTH IS EXPECTED TO CONTINUE

External market factors are likely to proliferate ongoing, steady growth in EGWPs for years to come. Here’s some significant reasons why:

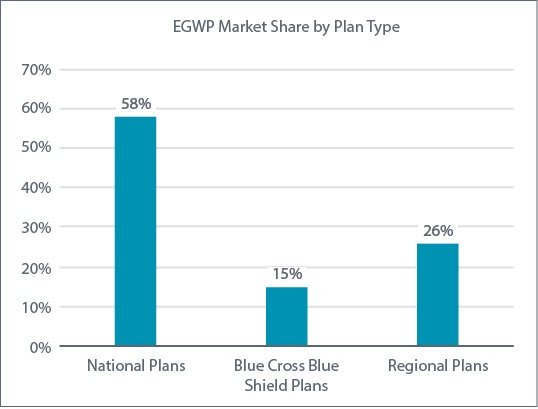

Strategic Focus for National Carriers

National carriers have already begun to strategically target the EGWP market. These organizations exhibit the necessary capabilities and sophistication to efficiently execute tailored MA product offerings for large groups. This means more competition for regional plans as well.

Changes in Medigap Plans due to MACRA

In 2020, the most popular Medicare Supplement plans (C & F) will no longer be available to newly eligible Medicare beneficiaries, as a result of MACRA regulations. These plans represent 63% of all Medicare Supplement enrollment nationally. Replacement plans will contain new deductibles not currently found in these popular plan benefits.

Employers are becoming increasingly well informed

Employers’ interest in value-based care and cost predictability for their retiree population continues to focus these groups on cost effective retiree health options, particularly in the public sector.

However, operational considerations are a factor for most regional plans

Penetration of EGWP products is currently lower than traditional MA, with some industry players projecting EGWP enrollment could double within five years. However, these group retiree plans require a distinct set of competencies that reflect capabilities for both Medicare Advantage and group benefits management. As a result, some regional plans have shied away from significant investments in the business processes, people, and technologies to build sufficient capabilities and competencies for group MA administration. Some plans are not adequately prepared to operationalize the opportunity.

HOW CAN ORGANIZATIONS CAPTURE THE EGWP OPPORTUNITY?

Paramount to success will be ensuring your organization’s readiness to operationalize EGWP product offerings. Operating an EGWP comes with additional administrative complexities, as it resembles a hybrid between commercial and individual MA products. As a result, we recommend conducting a gap assessment to identify the critical gaps in these core competencies for EGWP products. Often there is a need to redevelop key processes and procedures to take advantage of capabilities that may reside across the enterprise. For example, the ability to customize MA benefits offered to each group can create considerable challenges for plans who have only individual coverage today.

KEY OPERATIONAL AREAS OFTEN IN NEED OF REDESIGN

Marketing

- Proposal response process

- Group-specific collateral

- Sales training for both MA and Group Commercial field forces

Actuarial

- EGWP quote development process

- Customization rules, enrollment minimums, service area considerations

Operations

- Development of standardized EGWP product offerings

- Group installation

Compliance

- Training and monitoring of EGWP waivers

- Application of the balance of Medicare regulation in the group market

Sales

- Qualification of prospects

- Longer lead time for sales

- Staging sales pipeline based on potential client’s unique retiree population characteristics

Education

- Cross training of personnel on the unique nature of these products in terms of coverage, service area, waivers, customization, cost, and enrollment rules, so the organization can support its products and beneficiary inquiries

- Create EGWP SMEs to act as resources throughout the sales, installation, and product delivery processes

HealthScape encourages organizations to reevaluate the opportunity that could be associated with placing a greater focus on the EGWP market. Planning ahead to enable execution of key activities to prepare your organization for the strategic and operational requirements associated with offering EGWP products will pay dividends in the long-term.

HEALTHSCAPE CAN HELP.

We are experts in the Senior Market, having completed 130+ Medicare-related engagements and 85+ MA-specific engagements since our inception. For more information, contact Cary Badger at (206) 849-9437 or cbadger@healthscape.com.