OTC – A Missed Opportunity for Member Engagement

Over-the-counter (OTC) benefits have historically been used by health plans primarily as a marketing tool as well as a benefit for Medicare Advantage (MA) offerings, with value focused on member acquisition. However, as competitive dynamics in the MA market abound, many plans are looking for new ways to enhance plan offerings, improve enrollee experience, and evolve care management strategies. Armed with the belief that OTC benefits represent a valuable, often untapped opportunity to drive this clinical engagement and member experience, HealthScape Advisors and Pareto Intelligence partnered with the Consumer Healthcare Products Association (CHPA) to produce a study demonstrating clinical and corresponding member engagement opportunities within health plan OTC offerings.

The findings from this study support the notion that OTC benefits can be utilized by plans more actively to drive member engagement, satisfaction, clinical benefits, and retention. While the full study and analysis can be found above, this briefing will offer a targeted summary of key findings and implications for health plans, along with our recommended strategies for capturing the value of OTC programs based on these findings.

Current Health Plan Dynamics

For a brief history of MA plan OTC offerings and their rise in popularity, see our executive briefing from 2019.

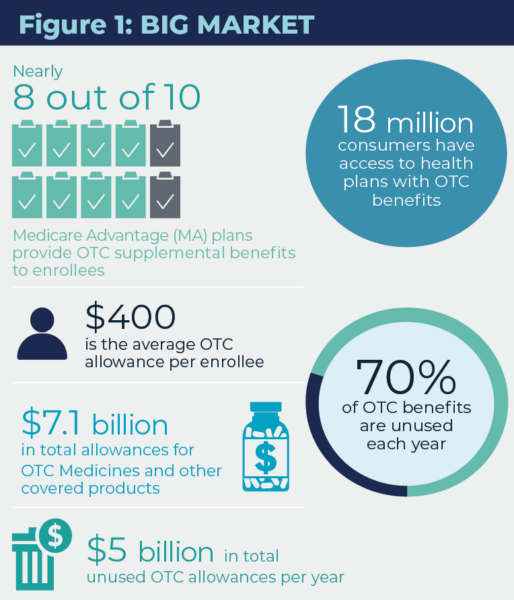

While OTC is one of the most popular supplemental benefits offered by MA plans with nearly 80% of plans including this product in their coverage, the prevailing strategy behind these programs has been member acquisition; i.e., improving the attractiveness of plan offerings to new and existing enrollees. As a result, OTC benefit programs are often passively managed, underpromoted, and consequently underutilized – only 30% of enrollees offered this benefit typically utilize it, leaving nearly $5 billion in allowances unused annually. Although this unrealized benefit results in lower overall cost to MA plans, there are missed opportunities to leverage current and future utilization characteristics to the benefit of the membership.

For example, MA plans have been more acutely focused on member engagement this year after experiencing the implications of failing to clinically engage members for retention and star ratings (e.g., CAHPS surveys). CMS has heightened this expectation by increasing member experience measures based on CAHPs and administrative data from a weight of two to four starting with the 2023 ratings. Based on these factors, health plans are now more focused on how to actively engage with members, but often overlook an important benefit that correlates to the member’s retail experience with the plan, OTC product/service selection and utilization.

Plans are now recognizing an opportunity to expand OTC program impact beyond member acquisition and retention, and start to leverage it within broader clinical, care management, and member engagement strategies. Some plans are now emphasizing OTC as a mechanism for engaging and offering value-added products and services to enrollees with greater social need, including those with financial vulnerability, inadequate access to transportation, and distance from retail pharmacy locations. That said, plans would benefit from further investigation to more deeply understand the impact that OTC programs can have for members with these social determinants of health (SDoH) barriers.

For plans looking to validate the potential contribution of an expanded OTC benefit program, the findings from our study are encouraging. The discussion below examines potential correlations between these benefits and members’ overall health.

This study evaluated an MA plan enrollee population of approximately 35,000 for the duration of 2020. Within this group, approximately 30,000 (85%) had access to OTC benefits, and 10,000 (33% of that cohort) used those benefits. The study segmented the population between users and non-users stratified by medical condition, and compared PMPM medical and pharmacy cost, inpatient admissions per 1000 enrollees and enrollee risk scores.

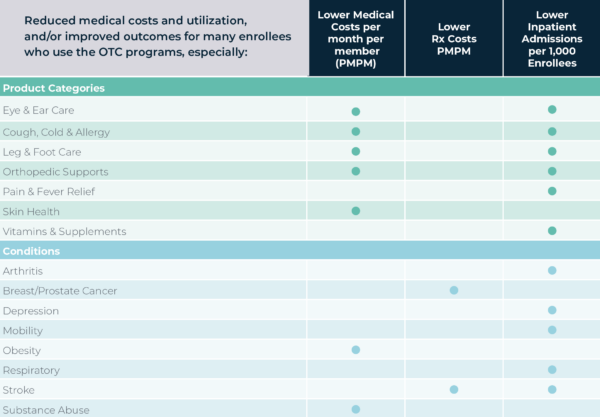

Members who utilize OTC programs are the same members that plans target for care management

Our findings demonstrated evidence of a positive correlation between use of prescription medications and inpatient admissions with utilization of OTC benefits. As such, we believe that OTC users are often higher utilizers of healthcare services in general, which are often the same enrollees that health plans seek to engage for other clinical and care management programs. Upon segmentation by medical condition, our findings were largely aligned to the aggregate trend; OTC benefit users were more likely to be enrollees with complex medical conditions and / or history of falls, endocrine and stroke. That said, there were some notable exceptions where OTC benefit users were associated with lower cost and utilization. Especially when cost reductions were realized in the form of reduced inpatient admissions (e.g., respiratory, mobility, and arthritis), we believe that the prevalence of effective OTC treatments and maintenance medications can have a positive impact on cost, utilization, and ultimately health outcomes for these cohorts. See Figure 2 below for additional findings by medical cohort.

MA OTC benefit programs create an opportunity for health plans to identify and engage enrollees likely to exhibit higher clinical need for broader care management and member engagement programs.

Health plans often expend significant efforts and funds to engage this high-need member cohort for various programs, many of which are built from the ground-up for the express purpose of care management or better member engagement. OTC benefit programs represent an existing touch point to members, through which plans can drive additional engagement and interventions to address gaps in care, improve quality measures, and positively impact member experience.

OTC benefit program use is associated with reduced medical costs and utilization in many cohorts

For many OTC product categories, we observed a correlation between OTC benefit program utilization and lower medical costs, pharmacy costs, and inpatient admissions (See Figure 2 below). Most notable product categories demonstrating measurably lower costs and admissions rates included ear and eye care and orthopedic supports. Based on these findings and the crossover between cost and utilization outcomes, we propose that certain OTC medicines and products can positively impact medical and pharmacy costs, utilization rates, and health outcomes.

OTC programs can be utilized for targeted care management and disease management efforts among certain medication cohorts or product categories. If segmented and engaged effectively, this can lead to reduced medical / pharmacy cost and improved health outcomes.

Figure 2: Findings by Product Category & Condition Type

How to Capture the Value of your OTC Program

So how can plans utilize these findings to accelerate the value created by their OTC benefit programs? At the root of this strategy is a shift in the way that OTC programs are viewed and managed. OTC and other “self-care products” are often not designed to coordinate with clinical programs or maximize clinical impact. Opportunities to coordinate on OTC and clinical information, programming and coverage are often missed by health plans. As we recognize the shift in OTC’s value proposition from a marketing tool to a more active member engagement and retention tool, the investment in capabilities needed to facilitate cross-functional collaboration and integration become more critical. Below are a series of steps that health plans can take towards more proactive management of their OTC benefit programs both internally and externally:

- Integrate OTC benefit utilization data into existing population health and care management reporting. This will allow for continual identification of trends and opportunities for engaging high utilizers through the OTC program process.

- Collaborate cross-functionally to deploy care management and enrollee experience focused programs including awareness campaigns, education, and support for appropriate, informed utilization of programs. These opportunities extend to quality and risk management efforts as health plans look to close care gaps and manage the risk of their populations.

- Consider partnerships between consumer health organizations and OTC product manufacturers to optimize program support, design and expansion related to MA OTC benefit programs. In order to do this effectively, plans should engage a strong OTC benefit vendor with flexibility of offerings to facilitate active utilization monitoring and member touchpoint capabilities (e.g., confirming fulfillment of OTC products).

- Explore opportunities to utilize OTC programs to address social determinants of health (SDoH) in senior and non-senior populations. OTC programs, and in particular home delivery-based programs, can provide a benefit and value to enrollees with SDoH barriers.

- Work towards expansion of OTC programs into other government healthcare offerings and insured markets, as well as value-based insurance design.

HealthScape & Pareto can help.

HealthScape invites players across the healthcare landscape to discuss their efforts around OTC program strategy and to collaborate in their expansion. Please contact Cary Badger (Principal, HealthScape Advisors) or Zain Jafri (VP of Innovation & Analytics, Pareto Intelligence) to discuss further.

Contact Cary Badger and Zain Jafri for more information.