A tectonic shift is underway in the Medicare Supplemental (Med Supp) market and it’s coming from a source rarely discussed—the Medicare Access and CHIP Reauthorization Act (MACRA). Beginning in 2020, insurers will no longer be able to sell the most popular Med Supp offerings, Plans C and F, to newly eligible individuals.

Section 401 of MACRA eliminates the ability for plans to cover the Part B deductible, effectively eliminating Plans C and F.

This change supports the government’s objective of curbing overutilization and spend through removal of first-dollar coverage for Part B services. It creates a new dynamic in a historically stable market. An understanding of the short-term and long-term implications of this change requires a quick dive into the mechanics of both MACRA and Med Supp.

MACRA—A PETRI DISH FOR RISK ARRANGEMENTS

MACRA, enacted in 2016, is a bipartisan law that was created to replace the sustainable growth rate (SGR) with a new approach to physician payment centered on value and quality of care. This shift from the traditional fee-for-service (FFS) approach to fee-for-value (FFV) is conducted through two tracks for value-based payment:

- Merit-Based Incentive Payment System (MIPS)—a model in which providers manage penalties

- Alternative Payment Model (APM)—a model in which providers manage risk

At a macro level, MACRA supports CMS’s objective to reign in the cost of the Medicare program by evolving the provider payment model to a valuebased approach. While the intent of this brief is not to outline strategies for succeeding in the age of MACRA, HealthScape’s whitepaper, MACRAnomics, takes a strategic lens on the growth opportunities ripe within it. Rather, this paper intends to stimulate discussion around the implications MACRA will have specifically on an insurer’s Med Supp strategy.

TAKING A STEP BACK—MEDICARE SUPPLEMENT

Med Supp, also known as Medigap, has historically been an attractive option for seniors as they age into Medicare to purchase insurance coverage for the cost sharing amounts not covered by Medicare. Participation grew to 13.1 million seniors in 2016, an increase of 6.6 percent from 2015, according to an AHIP report. The Med Supp market is dominated by a handful of large carriers with the likes of United Healthcare, Mutual of Omaha and Aetna as well as many small insurers.

A sub segment of seniors are attracted to these plans as they offer a greater level of financial security (compared to Medicare Advantage [MA]), but that comes at a generally higher price than comparable MA plans. The consumers purchasing a Med Supp product tend to be seniors with a larger fixed income in retirement.

Plan F remains the most popular, primarily attributed to the coverage of the Part B deductible.

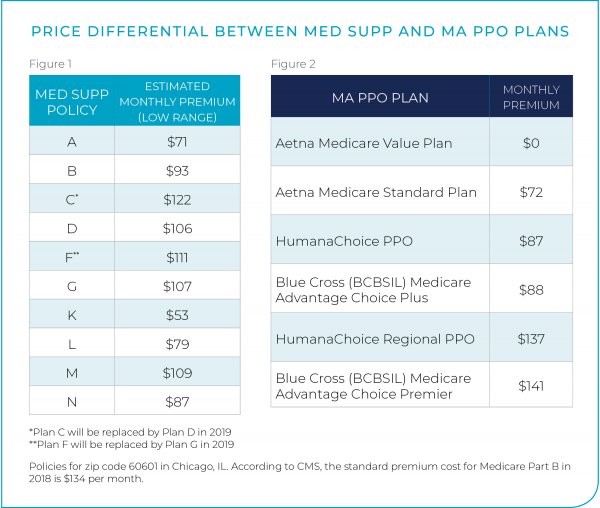

Of the 10 standard Med Supp plans, Plan F remains the most popular, primarily attributed to the coverage of the Part B deductible, meaning members’ coverage for Part B services starts with the first dollar of claims. With no deductible, beneficiaries access healthcare services without upfront cost sharing implications. Studies have found this purchasing behavior encourages overutilization of health services, inflating annual Medicare spend. One such study commissioned by MedPac in 2014 found that beneficiaries with first-dollar coverage were associated with significantly higher service use. Furthermore, an AHIP report found that Plan F accounted for 55 percent of enrollment across all Med Supp standardized plans. See Figure 1 on the following page for Med Supp policy premiums.

The economic levers of Med Supp are more reminiscent of the commercial market than its over 65 counterpart, MA. Like the commercial sector, Med Supp allows medical underwriting for certain beneficiaries, enabling insurers to manage the risk of their population. Unlike MA, Med Supp does not include risk adjustment of the premiums, giving more importance to risk selection through underwriting.

MARKET CATALYST

Congress added a provision in MACRA eliminating first-dollar coverage. Specifically, it bans insurers from selling Med Supp policies (i.e., Plans C and F) that cover the Medicare Part B deductible ($183 in 2018) to newly eligible enrollees effective January 1, 2020. This policy will bifurcate the Med Supp market into two consumer segments—non-newly eligible (NNE) and newly eligible (NE)—referring to their eligibility to enroll in Plan C or F.

Non-Newly Eligible: The NNEs are those that turned 65 or are Medicare eligible prior to January 1, 2020. These individuals are grandfathered into Plan C or F in that if they are enrolled in either plan prior to 2020, they can continue with their coverage. These plans will also be available to these members through historical guaranteed issue and underwriting provisions. In the long term, it is anticipated that premiums will rise as annual enrollment under these plans shrinks and the risk profile of those remaining increases.

Newly Eligible: The NEs cannot access Plans C or F as they become Medicare eligible after the effective date, and as such, they will be offered Med Supp plans with a Part B deductible.

Creation of an NE category doubles consumer segments from the pre-MACRA environment for Med Supp carriers. NEs will equally have the traditional Med Supp consumer segments: open enrollment, underwriting and guaranteed issue. This duplication of consumer segments will increase the complexity of strategy, actuarial and go-to-market initiatives (amongst others).

IMPACT TO CARRIERS

Consumer segmentation into NE and NNE member cohorts will require insurers to recalibrate their senior markets strategy before, during and after 2020, as plans sold in 2020 will need to be finalized in 2019. Key implications include:

CONSUMER ACTION: Changing Medicare Shopping Behavior and Profiles of Medicare Supplement and MA Consumers

In the pre-MACRA world, there was a clear “grand canyon” in the financial value proposition between Med Supp and MA product offerings. In comparison to MA members, Med Supp purchasers are generally more affluent. The post-MACRA world will likely see a convergence of the MA and Med Supp markets as the economic value proposition gap begins to close, causing a disruption in consumer behavior. There may be a trend of MA sales cannibalizing sales of Med Supp products as insurers can usurp new members that exhibit significantly different shopping behaviors than past enrollees.

PAYER ACTION: Disruption in Med Supp Creates Potential Opportunity in MA

The elimination of first-dollar coverage for Med Supp plans will bring the financial divide a bit closer to MA plans. A primary value proposition of Med Supp is that first-dollar coverage and its removal makes MA a more competitive offering. Carriers are now presented with the opportunity to attract beneficiaries into MA Preferred Provider Organization (PPO) products that may have otherwise opted for Med Supp plans. The MA PPO product, often the “Cadillac” of MA plans, is well positioned to attract these eligibles provided there is a robust provider network, rich benefit design with prescription drug coverage and self-referral to specialists.

See Figure 2 illustrating the competitiveness of Med Supp and MA PPO Plans.

Bundling Ancillary Services to Shield Against a Deteriorating Value Proposition

In response to a watered-down value proposition, Med Supp plans may deploy a defensive strategy for senior retention. Med Supp plans may bundle vision, dental and other ancillary services to target and seal consumer leakage to MA. Augmenting products with new innovations may partially restore their eroded value, positioning Med Supp plans to capture this shifting market. Some insurers have already capitalized on this opportunity. For example, purchasers of Med Supp coverage from Mutual of Omaha are automatically entitled to vision benefits through EyeMed. Mutual of Omaha’s Vice President and Actuary, Jeff Ganow cites this as “a direct result of what our customers told us would serve them well.”

Repositioning Med Supp Products for Newly Eligible

Carriers will need to reposition Plans D and G since they serve as the replacement for Plans C and F, respectively, for newly eligible Medicare beneficiaries effective January 1, 2020. Plans D and G function like their replacement plans but have a leaner benefit design which require beneficiaries to pay the Part B deductible. Further, Med Supp carriers will need to manage the mix of consumers from guaranteed issue and underwriting sources as the market disruption shifts from historical benchmark norms.

KEY QUESTIONS

Sustainability in the MACRA environment is not limited to positioning only Med Supp plans but rather it requires a holistic senior markets strategy. Outlined below are key strategic considerations that will help inform strategy and resource deployment:

- How does the local MA PPO market evolve in response to a weakening value proposition in the Med Supp space? Does your existing footprint enable market competitiveness?

- How does elimination of Med Supp Plans C and F impact competitor actions in senior markets before, during and after 2020?

- Market disruption creates opportunity for new entrants through aggressive pricing strategies and bundling. To what extent are you using your analytics to understand your current performance to inform strategy and respond to market dynamics?

- What investments in operational capabilities and/ or strategic positioning are required to support your strategic objectives?

The implications of MACRA present plans with an opportunity to recalibrate their senior markets product portfolio, augment capabilities to support the selected strategy and invest in solutions that optimize margin and growth targets. Those that have a myopic view of the evolving landscape and maintain status quo may see their Med Supp membership dwindle whereas those that use this market catalyst as a launchpad for integrated offerings, an analytical book of business assessment and the like may enjoy favorable competitive market positioning.

HEALTHSCAPE CAN HELP.

Since MACRA was enacted, it has created significant disruption for health plans. HealthScape has helped numerous clients navigate these changes, as well as the impact they have on other lines of business, to succeed in a post-MACRA world. Contact us for more information.