HealthScape Advisors is pleased to introduce this Executive Briefing focused on the importance of actively managing spend for intravitreal injections that treat serious eye conditions prevalent within Medicare Advantage (MA) plans’ membership populations. In this briefing, we will cover the prevalence of serious eye conditions and the use of intravitreal injections, a procedure that administers medication directly into the eye to treat these conditions. We will also highlight some key capabilities and strategies that health plans can consider to successfully address rising drug spend with a focus on intravitreal injections. MA plans must consider both insourced and outsourced solutions to ensure an optimal path forward.

Growing prevalence of ophthalmic conditions

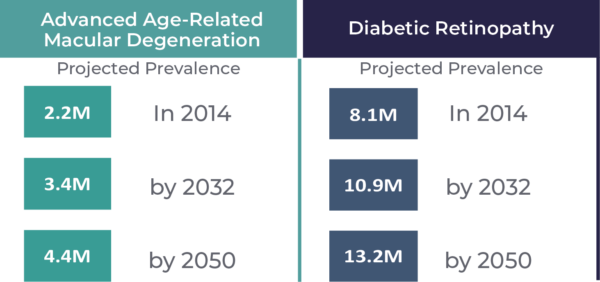

The rates of age-related ophthalmic conditions, such as macular degeneration, diabetic retinopathy, presbyopia and more, are climbing in the United States. While the higher expected prevalence rates are primarily driven by changes in the age distribution of the population, these prevalence rates are also impacted by shifts in overall health status, including specific conditions like diabetes. Individuals with diabetes are at an increased risk of developing certain ophthalmic conditions, and the number of seniors diagnosed with diabetes is expected to increase from 9.2M in 2014 to 29.9M by 2050.

FIGURE 1: EXAMPLE OPHTHALMIC CONDITION PREVALENCE

Some age-related ophthalmic conditions can be easily treated with non-invasive options. For example, presbyopia—the gradual loss of the ability to focus on nearby objects—is addressed through reading glasses. Presbyopia, and the seemingly endless collection of “cheaters” placed strategically around the house, is commonplace for many seniors. Other conditions, such as cataracts or serious dry eye, may require surgical intervention but can typically be successfully resolved. Certain retinal diseases, including wet age-related macular degeneration, diabetic retinopathy, macular edema and retinal vein occlusion, may require treatment with intravitreal, or intraocular, injections. Left untreated, these conditions can result in significantly impaired vision and possible eventual blindness. The primary focus of this discussion includes these conditions and their treatments.

FIGURE 2: OVERVIEW OF AGE-RELATED OPHTHALMIC CONDITIONS TREATED WITH INTRAVITREAL INJECTIONS

|

|

|

|

The benefits of anti-VEGF treatments

Only 15 years ago, wet aged-related macular degeneration was considered an irreversible disease. Left untreated, most individuals affected with wet aged-related macular degeneration would become functionally blind within approximately two years.

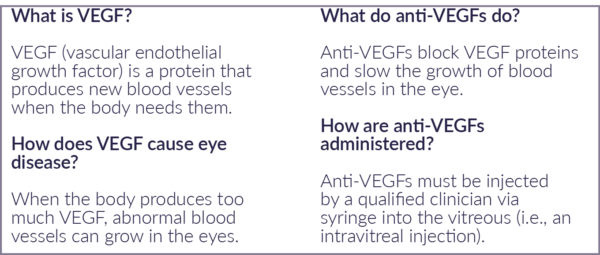

Today, anti–vascular endothelial growth factor (anti-VEGF) therapies stabilize, and can even improve, vision in individuals with several retinal conditions. Anti-VEGF treatments stabilize vision in 90% of individuals and improve vision in about one out of three individuals.

There is no question that intravitreal injections of anti-VEGFs have revolutionized the treatment and management of serious retinal diseases, including those shown above.

FIGURE 3: VEGF and Anti-VEGFs

Most frequently prescribed anti-VEGF treatments

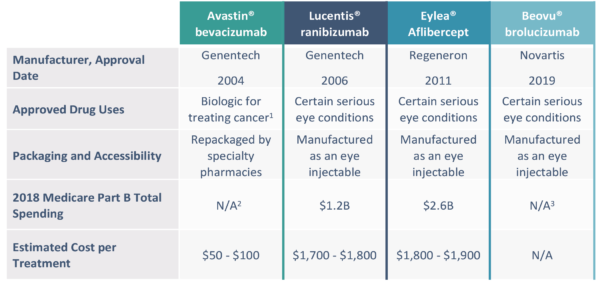

The two most prescribed options—Eylea® and Lucentis®—are manufactured and packaged specifically for injection into the eye to treat serious eye conditions. Another common treatment— Avastin®—is a biologic approved to treat several cancers but is also used off-label to treat serious eye conditions. Avastin® is not originally packaged as an intravitreal injection and is typically sent to a specialty pharmacy to be repackaged before distribution to vision providers (e.g., ophthalmologist). A fourth treatment— Beovu®—hit the market in late 2019 and offers a less frequent dosage schedule than its peers.

The cost of each of these treatments varies significantly. For example, Eylea® and Lucentis® are two of the most significant Medicare Part B drug spend drivers in the market. In 2018, Medicare Part B drug spending on Eylea® and Lucentis® topped $3.8B and accounted for 12.1% of all Medicare Part B drug spending. In fact, Eylea® has been the most expensive Medicare Part B drug in terms of total spending since 2015. Avastin®, on the other hand, may be a more cost effective alternative at about $50 per treatment for serious eye conditions.

Patient economics is only one of many factors, including treatment protocols and disease progression, that providers must consider when determining the optimal anti-VEGF drug.

FIGURE 4: OVERVIEW OF ANTI-VEGF TREATMENT OPTIONS1

Notes: (1) Avastin is an FDA-approved biologic for treating cancer that is frequently used off-label to treat conditions of the eye (2) Avastin’s 2018 Medicare Part B Spending and Dosage Units are not included as they are reflective of all uses and are not limited to spend related to the treatment of serious eye conditions. (3) Beovu was brought to market in 2019 and there are no 2018 part B spending figures.

How can MA plans address intravitreal drug spend trend?

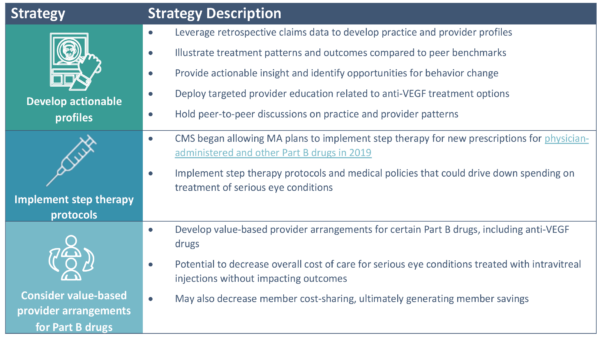

Many MA plans are taking notice of spend trend on intravitreal injections used to treat serious eye conditions. There are several strategies that MA plans should consider implementing to address this spend trend, three of which we have highlighted in Figure 5 below.

FIGURE 5: OVERVIEW OF HOW MA PLANS ADDRESS INTRAVITREAL DRUG SPEND

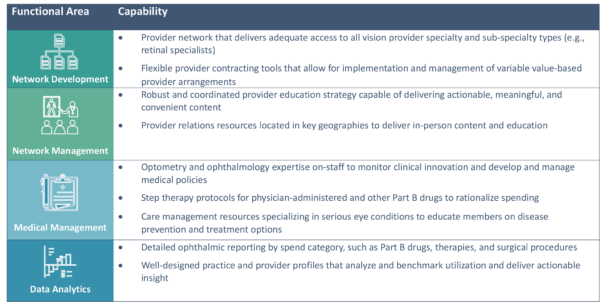

Considerations for an effective MA medical-surgical vision solution

As treatment options for ophthalmic conditions continue to become more sophisticated, the core set of capabilities needed to effectively manage medical-surgical vision and address Part B drug spend trend are also evolving. Looking to the future, MA plans must critically evaluate whether the best path forward is investment in internal capabilities and expertise to effectively manage medical-surgical vision or a partnership with a managed vision care plan specializing in this space.

FIGURE 6: EXAMPLE CAPABILITIES NEEDED TO EFFECTIVELY MANAGE MEDICAL-SURGICAL VISION SPEND

HEALTHSCAPE CAN HELP.

Ensuring MA plans have the appropriate capabilities, strategies and partners to manage intravitreal injection spend trend is critical, especially as clinical advancements continue and drug costs rise. Reach out to see how HealthScape can help you understand and evaluate opportunities to address intravitreal injection spend trend.

Contact Brian Goetsch for more information.