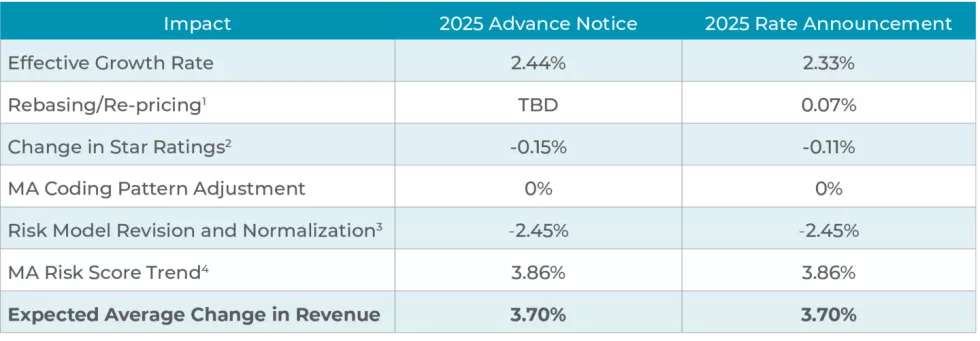

The Centers for Medicare & Medicaid Services (CMS) recently released the Final Rate Announcement for Calendar Year (CY) 2025. The announcement finalized a payment increase of 3.7% over CY 2024, which (as we previously reported) represents no significant change from the Advance Notice published on January 31, 2024. According to AHIP, many Medicare Advantage (MA) plans believe these policies “will put even more pressure on benefits and premiums” for their plans.

This update, created in partnership with our consulting actuaries, summarizes the implications to health plans and, more importantly, outlines the key actions health plans need to consider in light of these changes.

The Final Rate Announcement includes a small decrease in the effective growth rate from the Advance Notice. However, changes are not uniform in all states and counties. Two significant updates (growth rate calculation methodology and Part C risk model) will continue to be phased in over three years.

(1) Rebasing/re-pricing impact is dependent on finalization of the average geographic adjustment index, which was not available with the publication of the CY 2025 Advance Notice.

(2) Change in Star Ratings reflects the estimated effect of changes in the Quality Bonus Payments for the upcoming payment year. 2025 Quality Bonus Payments are based on 2024 Stars, which in turn are based on performance for most measures in 2022.

(3) The impact of the update to the fee-for-service (FFS) normalization factors for MA risk adjustment is not shown separately in the fact sheet because there is considerable interaction between the impact of the MA risk adjustment model updates and the normalization factor update. Therefore, the combined impact is shown in the fact sheet.

(4) The MA risk score trend is the average increase in MA risk scores, not accounting for normalization and coding pattern adjustments to MA risk scores, which are shown in separate rows. The risk score trend is calculated by using MA risk scores from 2018–2020, using the risk adjustment models and model blend as finalized in the CY 2025 Rate Announcement. The trend is an industry average and individual plans’ experience will vary.

What are the impacts for Medicare Advantage plans?

Growth Rate

Individual MA growth rates decreased 0.11% for the Final Notice vs. the Advance Notice. This adjustment is due to the inclusion of more recent payment data, up to the fourth quarter of 2023. It is important to note that the impact to individual counties’ benchmarks varies.

Technical Update

CMS modified the phase-in of a technical change to remove MA-related indirect medical education and direct graduate medical education costs paid to hospitals from the expenditures supporting the fee-for-service (FFS) United States per capita costs (USPCC) estimates. While initially proposed for a 67% adjustment in 2025, CMS has lowered that factor to 52%. The impact of the increase in phase-in from 33% to 52% is about a 0.5% reduction in 2025 trend.

Star Ratings

Star Ratings updates include the list of eligible disasters for adjustment, non-substantive measure specification updates, and the list of measures included in the Part C and D Improvement measures and Categorical Adjustment Index for the 2025 Star Ratings.

Part C & D Risk Scores

Part C risk scores will continue to be developed using a recalibrated hierarchical condition category (HCC) model, with 2025 being the second year of a three-year phase-in. As previously proposed, risk scores will be developed, weighting two-thirds on the new model and one-third on the current model for 2025. The new model includes a clinical update to the HCCs based on ICD-10-CM (vs. ICD-9-CM) diagnosis codes, and an update to the data years (2018 diagnoses and 2019 expenditures) based on the risk adjustment allowable CPT/HCPCS codes. The Part D HCC risk model is changing due to Inflation Reduction Act (IRA) changes.

Inflation Reduction Act Part D Updates

Updates include the elimination of the coverage gap phase to implement a three-phase benefit (deductible, initial coverage, and catastrophic) and the addition of a cap on out-of-pocket costs at $2,000 for CY 2025.

Bid-To-Benchmark Ratios and EGWP Impact

Bid-To-Benchmark (B2B) ratios have steadily declined over the last five years. A 100% quartile county’s B2B ratio has decreased for Employer Group Waiver Plan (EGWP) rate development for 2021 through 2025 as follows: 85.1%, 82.6%, 79.8%, 77.2%, 76.7%. The impact of this rising competitiveness on the part of individual plans puts downward pressure on EGWP rates.

What should MA plans do now?

Amid the outlook of continued financial pressure, MA plans will need to navigate the forthcoming changes and optimize their competitive positioning. We outline three critical strategies plans should prioritize in the near-term.

- Rebalance sales channel performance for long-term member value. Identify optimal channel mix and acquisition costs through a careful study of long-term member value by sales channel. This study should identify how each sales channel contributes to longer-term growth, retention, member health status management, and business performance.

- Develop a long-term product strategy. Establish longer-term strategic objectives for overall MA product strategy. Align this strategy with enterprise growth and go-to-market objectives on developing product capabilities for member engagement, clinical integration, and home and virtual care beyond the annual market cycle.

- Optimize medical costs. Develop targeted strategies and tactics to mitigate unfavorable medical cost trends through identification, prioritization and execution of short- and long-term improvement opportunities based on market dynamics (e.g., provider relationships, quality performance, regulatory requirements). This approach should be part and parcel to strategic planning efforts to achieve cost optimization.

HEALTHSCAPE CAN HELP

The healthcare landscape is constantly evolving, and keeping pace with regulatory changes and market shifts can be challenging for MA plans. We partner with plans nationwide to navigate these changes and achieve optimal performance.