With Infographic: Number of Highly Rated MA-PD Contracts Soars in Pandemic’s Wake

Reprinted with AIS Health permission from Oct. 21, 2021 issue of RADAR on Medicare Advantage.

Thanks to numerous flexibilities granted to plan sponsors during the COVID-19 public health emergency, nearly 70% of Medicare Advantage Prescription Drug (MA-PD) plans earned an overall rating of 4 stars or higher for 2022, CMS said on Oct. 8. That’s compared with just 49% of MA-PD plans in 2021. But the underlying data shows that quality improvements weren’t as impressive as the 2022 star ratings suggest, and with rising quality bonus payments (QBPs), the 2022 ratings could have major implications for MA revenue in the future, industry experts warn.

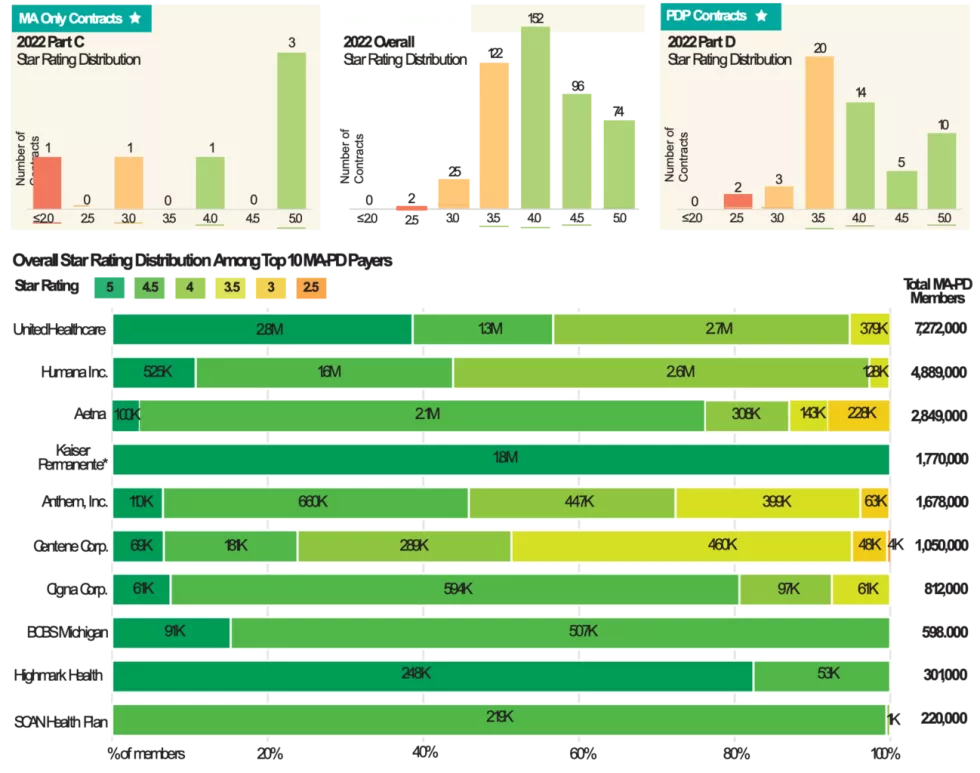

According to the CMS fact sheet released alongside the stars data, the average MA-PD star rating weighted by enrollment improved from 4.06 in 2021 to 4.37 for 2022. And 74 MA-PD contracts received the high performing indicator on the Medicare Plan Finder for earning 5 stars, compared with just 21 contracts for 2021 (see infographic). Fifty-three of those plans did not receive 5 stars last year. Weighted by enrollment, approximately 90% of MA-PD members are currently in contracts that will have 4 or more stars in 2022, CMS estimated.

“This year’s star ratings are just simply filled with a treasure trove of gifts from CMS to MA plans,” remarks Melissa Smith, executive vice president, consulting and professional services, at HealthMine, Inc., a Dallas-based health activation and engagement company. However, “those of us who eat, sleep and breathe stars believe this is a one-year anomaly.” That’s in part because, given the extraordinary circumstances of the COVID-19 pandemic, CMS in 2020 suspended the collection of Healthcare Effectiveness Data and Information Set (HEDIS) and Consumer Assessment of Healthcare Providers and Systems (CAHPS) survey data that would have impacted the 2021 star ratings and instead used the data from the prior year to calculate those ratings. In other words, explains Smith, about two-thirds of the 2021 star ratings were based on “holdover data.”

For the 2022 star ratings, CMS allowed plans to use the better of the two years’ rating (2021 or 2022) for most measures because all contracts qualified for the “extreme and uncontrollable circumstances policy.” For Part C measures not specific to Special Needs Plans, MA contracts reverted to the measure-level 2021 rating, on average, 3.9 times out of 20 measures eligible for the COVID-related disaster adjustment, explained CMS. And Smith estimates that allowing MA plans to revert to their actual 2021 star rating for six out of the 38 total measures introduced “artificial inflation on approximately 16% of the overall star rating.”

CMS Pulled Two Measures at Last Minute

On top of the COVID-related adjustments for 2022, CMS at the last minute removed two triple-weighted Health Outcomes Survey measures — Improving or Maintaining Physical Health and Improving or Maintaining Mental Health — which also boosted the ratings, points out Smith. Those two measures have always presented challenges for health plans, and the most recent average rating they had was 3.25 stars, she adds. Moreover, CMS delayed by one year a plan to implement guardrails on the ratings so that cut points could change by more than five percentage points “if national performance declined as a result of the COVID-19 PHE.”

In some ways, the 2022 ratings reflect actual performance from when the program was a little bit easier, suggests Jessica Assefa, senior director of star ratings with GHG Advisors, a Convey company. “A lot of what we’re seeing is not only that ‘better of’ star year 2021 vs. 2022 performance being pulled forward — one in a series of one-time COVID-enacted changes that made almost everyone a winner — but we’re also seeing past performance from all the way back in star year 2020 being pulled forward in these 2022 ratings,” she tells AIS Health, a division of MMIT. “And back then, the program was a little bit easier — the program was more stable, beneficiary experience metrics weren’t as highly weighted, the methodology wasn’t quite as complex as it is today.”

Meanwhile, “the underlying data shows an awful lot of weakness and erosion in performance that is masked by the COVID relief in the actual ratings,” asserts Smith. According to a CMS table displaying the average Part C measure scores prior to the disaster adjustments, plans performed worse on 16 out of 27 measures compared with the prior measurement year. These included measures related to preventive care (e.g., Breast Cancer Screening), plan performance (e.g., Complaints About the Plan), customer service (e.g., Call Center — Foreign Language and TTY Availability) and most of the chronic condition measures. In fact, five of six measures that showed a performance decline of greater than two points (on a 1-100 measure score) related to the management of chronic conditions.

Plans Should Brace for Tougher 2023

MA-PD plans’ improved performance this year “is a little deceptive,” agrees Assefa. “Plans that have been kind of riding on this historical strong past performance and haven’t really invested what they need to into interventions and strategies that they need to be successful might be unpleasantly surprised when the 2023 ratings come out and reflect their true performance from the prior measurement year.”

In the next couple years, the star ratings program will become significantly harder, she says. Controlling Blood Pressure and Plan All-Cause Readmissions will return from the display page, and CMS will adopt some complex changes to HEDIS metrics including the addition of two new measures — Transitions of Care and Follow-Up After ED Visit for People With High-Risk Multiple Chronic Conditions. In addition, member experience measures based on CAHPS and administrative data will move from a weight of 2 to 4 starting with the 2023 ratings, when the cut point guard rails are also implemented. The following year, CMS will introduce the Tukey Outlier Deletion Model, which will remove many low-performing outliers and shift cut points to the right, “making that 3, 4 or 5-star achievement at the measure level a lot more challenging for plans,” says Assefa.

On the Part D side, the ratings appeared to reflect plans’ strong response to COVID-related flexibilities around days’ supply, home delivery and prior authorization, as both MA-PD plans and PDPs showed more measure-level improvements than declines. The preadjusted data shows that MA-PD plans, on average, performed better by more than two points on each of the three medication adherence measures. Medication adherence for hypertension, for example, improved from an average star rating of 3.2 to 3.9.

“We saw a shift to the right in a lot of those measures where successful plans really dug in and ensured a positive experience and ensured folks were getting the drugs they needed,” observes Assefa.

Meanwhile, 10 PDP contracts will be highlighted with the high performing indicator, including six that did not earn it in 2021. According to the fact sheet, the average star rating for PDPs in 2022 is 3.7, up from 3.58 in 2021. CMS estimated that 54% of PDPs (29 contracts) that will be active in 2022 received 4 or more stars for 2022 and 42% of members are currently in PDP contracts that will have 4 or more stars in 2022, up from just 17% this year.

The wealth of plans achieving that elusive 5-star rating means there will be an unprecedented number of MA plans that are allowed to enroll and market their products year-round, adds Smith. “That really changes the entire 2022 enrollment trajectory.…Among those 74, there are significant efforts underway to go unlock their portion of the 10,000 baby boomers a day aging in in their service area and really use that 5-star anomaly rating to their maximum advantage, which is really interesting and really unusual,” she says. On the flipside, those efforts will require “a lot more work, investment and effort than their 5-star celebratory rating might lend them to believe.”

However, with the Medicare Hospital Insurance Trust Fund projected to run out in 2026 or sooner, paying out QBPs to 70% of plans isn’t sustainable, both experts advise. So, what may be viewed as good news today could lead to swift adoption of policy changes that impact MA plans’ pay, such as through changes to risk adjustment or the star ratings bonus structure. The Medicare Payment Advisory Commission (MedPAC), for one, has recommended moving to a more streamlined quality bonus program that evaluates plan quality at the local market level and distributes plan-financed rewards (and penalties). Assefa says plans would be wise to read those MedPAC proposals and understand the changes and methodologies that have been presented to Congress. “I would encourage them to dig in and say, ‘If the quality ratings program shifted to this methodology, am I still successful? Am I still in the game? Am I still able to meet those marks and deliver a financially viable high-quality product?’”

Number of Highly Rated MA-PD Contracts Soars in Pandemic’s Wake

By Carina Belles

Medicare Advantage Prescription Drug (MA-PD) plans’ star ratings soared to new heights for the 2022 plan year, according to an Oct. 8 data release. CMS reported that 90% of MA-PD members are enrolled in a plan rated at least 4 stars overall, compared to 77% in the 2021 plan year. Stand-alone Prescription Drug Plans (PDPs) also saw a significant boost for 2022, with 42% of members enrolled in a PDP rated 4 stars or above, up from just 17% this year. The COVID-19 pandemic was likely a driving force behind this dramatic upswing, as CMS made several regulatory changes to its data collection process amid the emergency and placated payers by qualifying all contracts for its “extreme and uncontrollable circumstances” policy, as outlined in the 2022 Star Ratings Fact Sheet. Among the top 10 payers, UnitedHealthcare’s share of members enrolled in plans rated 4 stars or above spiked from 74% to 95%, while Anthem, Inc. also saw a huge jump, from 51% to 73%. Humana held relatively steady at 97% (up from 92%), as did Aetna at 87% (up from 83%). Kaiser Permanente, notably, saw 100% of its MA-PD members enrolled in a 5-star plan. Just one payer in the top 10, Centene Corp., had any MA-PD contracts score below a 3. See the full ratings distribution for all contracts below, plus the ratings and enrollment distribution for the top 10 payers.