It’s that time of year again. At the start of every year, and particularly at the dawn of a new decade, the buzzing speculation of what is to come in the new year intensifies. In this Executive Brief, HealthScape has identified and distilled some of the most impactful market trends that will require health plans to make choices on how to prepare, participate and compete. While 2020 will see a continued focus on industry pressures—ranging from policy and regulatory shifts to rising pharmaceutical spend to the increased politicization of healthcare during an election year—we provide perspective on areas for plans to be proactive along the following five domains:

CONNECTING BEHAVIORAL AND PHYSICAL HEALTH | |

MOVING PAST THE BUZZ OF SOCIAL DETERMINANTS OF HEALTH | |

REDRAWING THE PAYER-PROVIDER LINES | |

EXPANDING INFLUENCE OF TECH GIANTS ON HEALTHCARE | |

FEELING THE IMPACT OF WELL-FUNDED NEW ENTRANTS |

In our discussion, we highlight the implications of these areas and their elevated importance in 2020, particularly as many of these are not “net new” market forces but rather those that we think will have a material impact in 2020.

Our review of anticipated market shifts points to a singular theme—integration. Integration has historically been an under-appreciated term referenced primarily for linking disparate technologies; however, integration in 2020 emphasizes the trend towards greater connectedness. Whether that manifests into integration of behavioral health and health and human services (#1, #2), technology (#4), payers and providers (#3) or with external partners (#5), all five areas require health plans to think about greater integration across their internal operations and with external partners and solutions.

Fundamentally, the industry is deviating from the notion that a single entity will have the capabilities and scale to address the myriad of healthcare challenges. Rather, market success will be predicated on integrated solutions. We believe that health plans that adapt and integrate relevant solutions for this new paradigm will be best positioned to succeed.

#1. CONNECTING BEHAVIORAL AND PHYSICAL HEALTH

The gap between the demand for behavioral health services and the availability of adequate treatment options has never been wider. While the importance of behavioral health has been long understood, we believe that plans are reaching an inflection point towards increased investment and action as many historical barriers to behavioral health services are going away.

- The Industry Recognizes that Co-Morbidities Drive Increased Spending: The mind and body are indisputably related. Nearly one in five American adults lives with a behavioral health condition and nearly half of those with a mental illness have two or more disorders. Significant cost savings could be derived given that individuals with a behavioral health co-morbidity are associated with more than twice the spend of those without these conditions. A 2017 analysis estimates annual cost savings between $38 billion and $68 billion collectively between commercial insurance, Medicare and Medicaid if behavioral and physical health services are effectively integrated.

- Generational Shift in De-Stigmatizing Behavioral Health: Compared to older generations, millennials are generally more open to addressing issues and embracing others with mental illness. This is partly attributed to their longtime exposure to anxiety, depression, suicide and eating disorders, making them not only more likely to speak out but also to seek treatment for behavioral health issues.

- Plans Shift Away from Behavioral Health Carve-Outs: Health plans across all lines of business are exploring strategies to effectively administer behavioral health. In many cases, behavioral health is being carved in. Medicaid programs clearly demonstrate this trend, as behavioral health carve-outs declined from fifteen states in 2011 to nine states in 2019; this represents a shift towards integrated solutions that combine behavioral and physical health services.

2020 is expected to continue the exploding trend towards increased awareness, investments, and solution developments to better address behavioral and mental health. Given the demand for care and the downstream impact on cost, health plans today must prioritize integration of behavioral health services with traditional medical care. As the industry looks forward, “whole person care” that recognizes the duality of both a healthy mind and body will be critically important. These new models of care, beginning with primary care, will replace “carved-out” behavioral health programs, which have historically led to disjointed care delivery. As such, the new age of behavioral health treatment will evolve to models that are integrated with consumers’ physical health needs and focused on ease of access, supportive therapy, and personal choices.

In November 2019, Quartet Health partnered with Cambia Health to integrate primary and mental health care across Cambia’s health plans. Through Quartet’s artificial intelligence platforms, providers will be able to identify patients that need behavioral healthcare. In July 2019, Horizon Blue Cross Blue Shield of New Jersey and AbleTo announced the launch of a new virtual behavioral healthcare program for Medicaid members. The program is backed by AbleTo’s health data analytics technology which identifies members that would benefit from behavioral healthcare and connects them with a network of professionals.

#2. MOVING PAST THE BUZZ OF SOCIAL DETERMINANTS OF HEALTH

A 2018 Kaiser Family Foundation report found that social factors and personal behaviors contribute to 60% of an individual’s longevity. While social determinants of health (SDoH) has gradually proliferated as an industry buzzword, only recently has the industry recognized and addressed these social barriers to begin making a meaningful impact on health status.

We see 2020 as the year the buzz becomes more actionable, as plans enter the uncharted territory of providing financial, housing, and educational support. Historically, healthcare organizations and social workers have focused on social barriers, but what is different now?

- Data and Analytics: Historically, plans have not focused on capturing and analyzing data to identify social issues; however, advances in data and analytics across health plans and systems are now allowing organizations to incorporate social determinant risks to develop and inform actionable member and provider engagement strategies.

- Cost Management Strategies: Previous efforts focused only on the highest risk members to help control costs, but the long-term ability to bend the cost curve is jeopardized if health plans do not address underlying social

determinants. - Medicaid Expansion: Increased focus on Medicaid has pushed an emphasis on SDoH with these members typically experiencing greater social barriers. In 2018, managed Medicaid served approximately 75% of 75 million Medicaid beneficiaries. We expect greater health plan emphasis on social determinants to address state contract requirements and to effectively manage the risk of this population.

- Value-Based Payment Models: Value-based models create greater flexibility to cover services related to social determinant risks (e.g., transportation, food insecurity), and payment reform may include additional ICD-10 codes for SDoH.

As the focus on SDoH reaches critical mass in 2020, it will become an imperative that health plans develop scalable and impactful solutions through targeted investments in community-based resources, integrated member management strategies and technology enablement tools.

UnitedHealthcare announced in April that it invested more than $400 million to increase affordable housing access in over 80 affordable housing communities nationwide. For members enrolled in these housing programs, emergency room admissions dropped by 60%, while the total cost of care was cut in half.

#3. REDRAWING THE PAYER-PROVIDER LINES

Seeking greater ability to influence quality, cost and the member experience, health plans have adopted varying strategies to accelerate integration with care delivery. While some health plans started (and continue to focus on) value-based contracts, more are expanding into plan-provider partnerships, joint ventures and even entering care delivery themselves. Several factors contribute to an increasing trend of direct or joint provider asset ownership:

- Proactive vs. Reactive Stance: Health plan investment in providers/delivery systems has often been reactive to external market events or competitive threats; however, this defensive stance will need to be re-evaluated, given the changing market dynamics. UnitedHealth Group intends to grow OptumCare to a $100 billion business over the next ten years, and other large national plans have embarked on their own aggressive delivery system strategies (e.g., Aetna via its CVS HealthHUB; Humana through growth of its Conviva brand centers, Partners in Primary Care Clinics and acquisition of Curo Health Services).

- Underperforming Value-Based Contracts: Many contract-based programs have yielded sub-optimal results related to cost and quality. Furthermore, these programs pose administrative and operational challenges, creating further headwinds to return on investment. Many health plans are evaluating delivery system ownership, especially in primary care, as an opportunity to achieve their desired quality and cost goals in a more direct way. And while the shift to value-based payment will continue, these programs may be less complex to develop and administer with owned care delivery assets.

- Platform for Total Cost of Care Management: In contrast to contractual models, truly integrated joint ventures and direct ownership of delivery system assets can create a platform to more effectively influence and achieve desired quality and cost goals. Primary care is often the foundation of this platform and creates the chassis onto which health plans can layer additional investments and partnerships in specialty health, such as infusion, dialysis, specialist care and high-end imaging.

As we look forward to 2020, we expect continued interest in more proactive and direct provider relationships, as the trend toward vertical integration forces plans to examine their approach or risk being shut out of potential provider partnerships in the market.

From value-based care to the value chain, the lines between health plans and health systems will continue to blur. Blue Cross and Blue Shield of Texas partnered with Sanitas to open 10 “one-stop medical centers” in Dallas and Houston, and with these centers, will deliver primary care, urgent care, lab testing and wellness programs to patients. Florida Blue has been expanding its Sanitas Medical Clinics since 2015; in 2020, 34 additional clinics are expected to open in Central and South Florida.

#4. EXPANDING INFLUENCE OF TECH GIANTS ON HEALTHCARE

While new entrants and the start-up community have helped consumer tools and digital apps gain traction, advancements by tech giants, including Amazon, Google and Apple, will begin to move the existing disparate touchpoints and disorganized data into meaningful platforms for consumers and health plans. Health plans have long boasted digital improvements, but efforts have mostly resulted in interesting pilot solutions that have failed to achieve scale and meaningful impact. We expect this to change as each of the major technology players works to solidify its positioning in the health tech space; each hopes to impact healthcare consumerism, increase data access and provide informed analytics that, over the longterm, will drive lower cost and higher quality care.

- Consumer Devices are the New Battlefield for Tech Giants: While health plans have historically failed to crack the code of scalable member engagement, technology companies are better positioned for success, leveraging popular devices (e.g., FitBit, Apple Watch) as their entry point into healthcare. Whether by acquisition or internal build, these solutions centralize and integrate engagement around a singular device that consumers already want and use. This model will drive greater adoption and allow these tech companies to obtain more data regarding consumers and their healthcare decisions/patterns, furthering the current understanding of consumer healthcare behavior.

- Data and Analytics as a Symbiotic Relationship: In addition to the insights from devices, healthcare technology companies are increasingly partnering with health systems to access clinical and nonclinical data. As these partnerships scale, insights from this data combined with the insights gained from the consumer device platform mentioned above will help accelerate data and analytic capabilities as well as enable more advanced and personalized consumer engagement models.

- Outcomes that Improve Health and Lower Cost: The insights obtained by the above-mentioned data sources will enable technology companies to create lower cost solutions that engage members in their healthcare for improved outcomes. If successful in reducing traditional healthcare consumption, technology companies will be best positioned to capitalize on the emerging growth opportunities from this engagement platform.

Between 2013 – 2017, Alphabet filed 186 healthcare-related patents and countless collaborations. Notable ones include:

- FitBit (2019) – hardware play into lifestyle management

- DeepMind (2014) – exploring ways to leverage AI in healthcare

- Calico (2013) – research organization focused on extending human lifespan

- Verily Life Sciences (2014) – Alphabet’s research organization utilizing data analytics to improve healthcare

The continued evolution of reimbursement models, such as the Centers for Medicare and Medicaid Services’ (CMS) expanded definition of remote patient monitoring, will encourage technology companies to move into healthcare. We predict that 2020 will be the year that health technology companies pivot from being point solutions to marketplace enablers and disruptors. These actions will serve as the starting point for seamless omnichannel interactions as well as the platform to support robust, AI-enabled health solutions that leverage evidence-based medicine, genomic profiles and everyday lifestyle factors.

#5. FEELING THE IMPACT OF WELL-FUNDED NEW ENTRANTS

The pending “disruption” from new competitors in the health plan space has been well publicized and welcomed by industry observers. Traditional incumbent health plans have been labeled as stagnant and unwilling or unable to respond to consumer and employer needs for an affordable and uncomplicated healthcare marketplace.

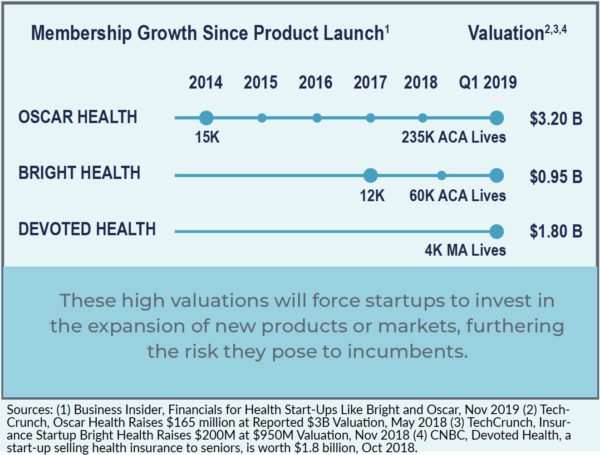

Changes in government regulation and a market imperative to address these cost and navigation challenges have led to media splashes and never-before-seen valuations for companies entering or disrupting the health plan space. Although the impact of these ventures has been relatively muted to-date, two major categories of market disruptors are beginning to challenge the way healthcare is accessed and funded:

- Maturing Start-Ups: New entrants such as Oscar Health, Devoted Health, Haven Health and Bright Health are growing aggressively into new markets and some are beginning to reach profitability. Although they have historically been treated by industry incumbents as non-factors due to their small scale, these emerging plan competitors are well funded, have made significant investments in technology platforms, and embody unique and innovative business models and solutions that the industry can no longer ignore. As they increase market penetration, traditional plans will need to find ways to either compete with them or leverage their ideas.

- Expanding Services through Retail Health: Predicted to grow at a compound annual growth rate of 20.3% from 2017 to 2025, retail clinics are aggressively expanding, with the announcement of new partnerships, acquisitions and solutions: CVS, amidst its integration with Aetna, has announced plans for 1,500 HealthHUB locations by 2021; Walgreens is advancing its healthcare strategy through a variety of health plan partnerships; Sam’s Club is offering discounted healthcare bundles of services; and Walmart is expanding its direct access to care through clinics and transparent direct-to-consumer pricing. While it is too early to gauge the impact of these measures, they pose an increasingly competitive threat to existing health plan business.

2020 is poised to be a potential inflection point where the words “potential” and “pilot” begin to transition to “competitor” or perhaps “partner,” causing health plans and providers around the country to determine their own best path forward under an advancing market norm.

Haven Healthcare will offer tens of thousands of Amazon, JPMorgan and Berkshire Hathaway employees zero deductible plans, administered by Cigna and Aetna, that also feature a wellness program with employee incentives.

IMPLICATIONS

Given the expected impact of these 2020 healthcare trends, we’ve identified several strategic areas of focus for health plans that apply across the market shifts described above. Organizations should consider their readiness and capabilities in these areas to ensure that they are prepared to respond to continued market shifts.

Develop Data Infrastructure and Acquisition

Each of the above-mentioned topics will accelerate the volume and variety of data that health plans must digest (e.g., clinical data, social risk factor data, real-time data from wearables and Internet of Things [IoT]). A plan’s ability to use the increasing volume of data from these technology platforms will be predicated on having a well-defined data strategy that includes people, process and technology components that allow health plans to unlock the business value of data and prepare for the next wave of data elements.

Explore Strategic Partnerships and Innovative Care Models

The emergence of healthcare technology companies and other disruptors will require health plans to evaluate and define their response to these potential market threats. Health plans must assess their definitions of “friend” or “foe.” In some cases, it may be better to align with these new entrants as partners. Given that many others are facing this same dilemma, it will become increasingly critical to quickly define unique value propositions in the market. For many smaller plans, it will be impossible to compete on a scale and capital basis against these well-funded entrants, which will require plans to consider outsourcing arrangements or partnership with other like plans.

If you can’t beat them, join them. Blue Cross Blue Shield of Massachusetts announced a new feature in its MyBlue member app and website that enables members to manage and fill their prescriptions with PillPack by Amazon Pharmacy. As the first health plan offering direct pharmacy integration with PillPack, Blue Cross Blue Shield of Massachusetts will leverage PillPack’s core services to provide its members a more convenient way to manage their prescriptions and medications.

Design Consumer-Centric Engagement Solutions

Healthcare organizations will need to break down historical siloes to be successful. This will require engaging consumers based on their needs rather than traditional health plan operational ease. Examples of this evolving consumer experience include improved connection points between the health plan, providers and technology to wholly integrate behavioral health delivery with physical health.

Evaluate Sources for Growth

Given this constantly evolving market landscape and ongoing market threats, health plans must evaluate the feasibility of growth from existing lines of business (e.g., group, Individual, government programs) to determine whether they should enter into new health plan segments or whether additional diversification is required. If diversification is needed, health plans must have a clear understanding and strategic rationale for which types of diversified businesses represent the greatest growth potential, including a business case/plan and roadmap for investment.

HEALTHSCAPE CAN HELP.

We have experience evaluating local market dynamics to help our clients stay ahead of key market and regulatory events. Contact Alexis Levy, Jesse Owdom or Tej Shah for more information.